Happy Weekend All,

I bring rather bad news in tonight's post. I think the Australian market has topped. I have been pouring over the weekly charts of some of the major stocks of late and the technical situation from a big picture perspective is real bearish indeed. All rather sobering charts so perhaps now is the time to pour yourself a scotch as you read this.

I must stress from the outset that these are WEEKLY patterns and thus perhaps not immediately actionable for many traders. I have been saying for a while that I think a short term tradeable low is forming and I still believe this may be possible. The simple fact that I am writing this now may be indicative of peak bearish sentiment i.e the worst time to be short. However, if my read on these charts is correct, as we draw to the end of the summer you will want to really be getting out of this market. It feels a lot like 2007 and drawing on experience is paramount. To reiterate where I think we are at in the more immediate short term, pls read this: http://swingtradersedge.blogspot.com/2011/06/party-like-its-2007.html

And so to the big powerhouse of the Australian market, BHP. The resource major has formed a huge Double Top pattern. The inability to break its previous highs should be viewed as an indication of a major trend reversal.

BHP Weekly:

Double Top at 50. A nice area and number for a major topping pattern. Note the weekly trendline break

If you want an example or a reminder of what happens out of these kind of ending patterns, look no further than the S&P 500.

S&P 500 Weekly:

Double top and then major trend reversal. No doubt the 2007 top took time to build but all the warning signs were there.

BHP Daily:

Back to BHP and in the short term we are testing support. I still think there is the possibility of a good bounce out of here. Should this materialise, we could also be looking at a possible Head and Shoulders top.

NCM Weekly:

Another major materials stock. Another Double Top pattern. Note the 3 wave push into the recent high

FMG Daily:

Looking like a Head and Shoulder top is forming here

WOR Weekly

Double Top pattern and shorter term rounding top. Really ugly weekly chart

The energy sector is not looking particularly healthy either.

STO Weekly:

Santos has formed a major top pattern. Price is testing the low end of the range in short term but I would view good bounces as a great time to get out or short this stock

WPL Daily:

A test and failure to break higher. Major topping reversal candle. Testing low end of range for now

OSH Weekly

Failed breakout and now a head and shoulders top is forming.

Finanical stocks are not looking too healthy either.

CBA Daily:

CBA tried to break out of a multi month consolidation pattern and failed spectacularly. Note that price topped right on the 61.8 fib retracement. If 49/48 breaks to the downside, I could see a move right back down to 40.

ANZ Daily:

Double or triple top? Call it what you want, it cant break higher

How is tech looking?

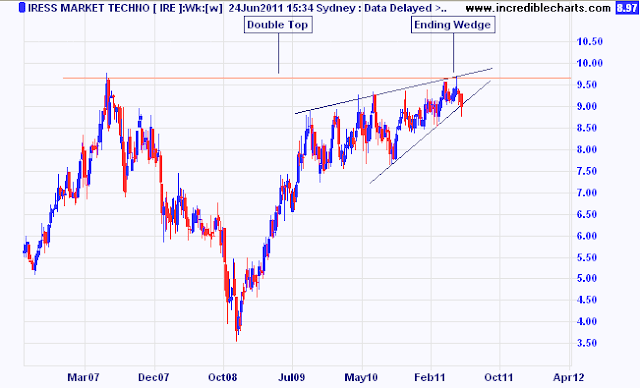

IRE Weekly:

Not so good. Look out below when this ending diagonal breaks.

You know a market is in trouble when even the defensives look like they have topped.

CCL Weekly:

Coca Cola Amatil has formed an ending wedge and possible double top

COH Weekly:

Double top and ending wedge. This shows what happens when these wedges break- price falls hard and fast.

This is the one chart that really scares me. In fact, this really could be the last shoe to drop and is indicative of the final hoorah

ILU Daily:

Do you want to hold a stock that is almost vertical? Sure I could change to log but seriously, this is absurd. I just don't see how this stock can keep up this velocity. This is a bubble

Silver Daily:

Want to see what happens to a market that is vertical- it finally implodes in ghastly fashion.

I could pull up more but I think you get the message. The big picture in Australia looks horrible. I would be using any good bounces over the next month into August to be getting firmly out of this market and hoarding up. Hopefully I can guide you through and offer helpful suggestions as this plays out. These are topping patterns and if my work is worth anything, then this message should be heeded.

Thanks

Austin