Morning All,

Nothing clear coming into today. This market remains in a range and no doubt the move in Equities will come as we reach a resolution with the Debt Ceiling. I am amazed at how resilient (or complacent) the market is currently despite this genuine potential threat. I have always been of the belief that a market that shrugs off bearish news is indicative of a strong underlying trend. We will see.

Looking at the S&P 500 index, the market appears in a short term consolidation pattern. 1330/1228 is key short term support and as long as this holds, look for short term breakout trades for a retest of the highs.

S&P 500 Cash 15mins:

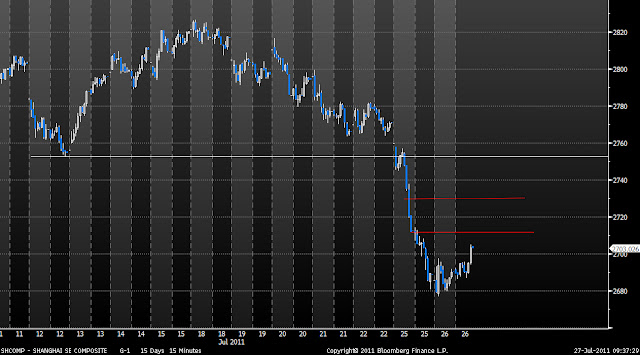

In Australia today, the SPI futures are indicated at 4520 right back down to yesterdays lows. I really do not have a clear pattern or setup currently. In situations like this, I like to trade the levels and keep it really nimble for scalps only. I am looking at 4505/4500 as support and 4540 as resistance. I will have my eyes firmly on the Shanghai Composite when it opens today. Given the strong breakdown the other day and new momentum low, the highest probabilty trade is to short the first bounce looking for a retest of the low. 2715 and 2730 look like potential resistance areas today.

Shanghai Comp 15mins:

Bigger picture there are a number of markets now "testing" their previous highs whilst other still lag which is setting up all kinds of divergences and dislocations. AUD is now testing 1.10, the Nasdaq 2415/2420 and Copper is on its way to test its previous highs. Possible double tops? Note S&P 500 still remains some 20points off its high whilst all Asian indices are well off their highs with some breaking out of consolidation patterns whilst others such as Australia languish. Not an overall healthy picture to me.

Austin