Morning All,

Last night the S&P 500 closed above key resistance and continues to build on the low I have been talking about here. I am sure the papers will be littered with headlines this morning about the successful resolution of the Greek problems causing the market to rally. Ha. Just remember, we bottomed 8 to 9 days ago. Price moves first, then the news comes second. I do still think this market has higher to go still and I will put up a post later on today with potential targets.

S&P 500 Daily:

Confirmation of breakout pattern.

AUDUSD

Also saw a successful breakout of the wedge pattern. Currencies love the round numbers and 1.04 proved to be a formidable trading low. Still looking for a retest of 1.10

To Australia today. The XJO tested and successfully held the March lows. Note that price consolidated below this level but there was no follow through to the downside. This is indicative of a classic bear trap and is inline with countless other setups I have seen and posted about throughout Asia: http://swingtradersedge.blogspot.com/2011/06/why-i-still-like-asia.html.

If the XJO trades and closes above 4565 we have a confirmed short term trend change i.e. High, higher low and then new high. See chart below

XJO Daily:

SPI futures are indicated to open at 4545/4550 thus a 30 point gap up. The key resistance levels are 4550/4555 and then clear room up to 4590/4600. My plan today is to look to fade the opening move in the 50s and if there is no follow through to the downside, I will be looking to join the breakout higher. It is interesting that the market has failed to build on any of the overnight gaps (i.e. go on to make a new intraday high) over the past month or so. When the market does, that will be indicative that the character of the market has changed at long last. I am hoping today will be that day.

Twitter Feed

Thursday 30 June 2011

Wednesday 29 June 2011

Switching To Guns

Morning All,

A strong bounce in the US markets overnight has taken us right into recent resistance. The market has transitioned from a clear downtrend, to volatile sideways base building, and now we are on the cusp of a genuine breakout. Breadth has improved and fear peaked right on the low. I am sure there are many traders who are fully aware of this 1295/1300 resistance zone in the S&P 500 and there will be a lot of buy stops above this level. Bottom line, I think this level gets breached and we will continue to see an advance up to at least 1320. Then we see. This market continues to follow the 2007 scenario I have been talking about: http://swingtradersedge.blogspot.com/2011_06_16_archive.html.

S&P 500 Daily:

A strong base pattern has been built and we are now testing overhead resistance. Look for breakout trades and switch to guns.

Nasdaq 100 Daily:

This market is always a lead indicator. Price has already broken out of the recent base pattern. A new trend up has begun

I showed this chart the other day and I thought now would be a perfect time to update. In almost all the significant low points in this bull market, the S&P 500 has built a solid base prior to a strong breakout. I believe we are at a very similar junction.

S&P 500 Daily 2010- Present

To Asia today. My thoughts have not changed since my recent posts:

http://swingtradersedge.blogspot.com/2011/06/why-i-still-like-asia.html

AND http://swingtradersedge.blogspot.com/2011_06_20_archive.html.

I believe we have seen peak bearishness and a number of failed technical patterns which all imply to me that this rally has more to go. Australia has been a laggard in the region no doubt. However, we are looking at yet another strong gap up today and if this should hold in the first 30mins above 4500, I feel that finally our time has come to transition out of this downtrend. It is all about developing a low risk idea and pursuing it until proven wrong.

Thanks

Austin

p.s. Currencies are always an important lead indicator to me. I don't see too much panic in these 2 patterns. Looking for breakout trades also here

AUDUSD Daily:

EURUSD Daily:

A strong bounce in the US markets overnight has taken us right into recent resistance. The market has transitioned from a clear downtrend, to volatile sideways base building, and now we are on the cusp of a genuine breakout. Breadth has improved and fear peaked right on the low. I am sure there are many traders who are fully aware of this 1295/1300 resistance zone in the S&P 500 and there will be a lot of buy stops above this level. Bottom line, I think this level gets breached and we will continue to see an advance up to at least 1320. Then we see. This market continues to follow the 2007 scenario I have been talking about: http://swingtradersedge.blogspot.com/2011_06_16_archive.html.

S&P 500 Daily:

A strong base pattern has been built and we are now testing overhead resistance. Look for breakout trades and switch to guns.

Nasdaq 100 Daily:

This market is always a lead indicator. Price has already broken out of the recent base pattern. A new trend up has begun

I showed this chart the other day and I thought now would be a perfect time to update. In almost all the significant low points in this bull market, the S&P 500 has built a solid base prior to a strong breakout. I believe we are at a very similar junction.

S&P 500 Daily 2010- Present

To Asia today. My thoughts have not changed since my recent posts:

http://swingtradersedge.blogspot.com/2011/06/why-i-still-like-asia.html

AND http://swingtradersedge.blogspot.com/2011_06_20_archive.html.

I believe we have seen peak bearishness and a number of failed technical patterns which all imply to me that this rally has more to go. Australia has been a laggard in the region no doubt. However, we are looking at yet another strong gap up today and if this should hold in the first 30mins above 4500, I feel that finally our time has come to transition out of this downtrend. It is all about developing a low risk idea and pursuing it until proven wrong.

Thanks

Austin

p.s. Currencies are always an important lead indicator to me. I don't see too much panic in these 2 patterns. Looking for breakout trades also here

AUDUSD Daily:

EURUSD Daily:

Monday 27 June 2011

Why I Still Like Asia

Morning All,

I had a question the other day from a reader who wanted an update on the Chinese and Indian markets. In the past, I had shown broad consolidation patterns for both these regional powerhouses and now is an opportune time to update.

I put out a post the other day on the most important rule in technical analysis: http://swingtradersedge.blogspot.com/2011/06/most-important-rule-in-chart-analysis.html. I wrote this to try and illustrate the weaknesses in "classic" technical patterns that most of the market look at, and to try and prepare myself for a possible bullish reversal when all was looking doom and gloom. Obviously I had no idea if these patterns would fail but my experience has taught me to be very wary in such situations. My central point is- if a market fails to follow in the direction of a trading signal and pattern, it is a strong indication of a strong reversal in the opposite direction. I believe we are now seeing this reversal in the Shanghai Composite, the Hang Seng and the Nikkei. Other regional indices are also holding key zones. It is obviously still very early days and US indices are hardly looking rosy. However, I like these risk/reward setups in the short term.

Firstly, to China. There was a close below the big weekly triangle pattern that brought the bears out. It is at these times that fear hits a fever pitch as shown in some of these posts: http://www.zerohedge.com/article/chinese-1-and-2-week-shibor-rates-surge-over-9-highest-2007 and the mighty Goldman Sachs head technical analyst (go to page 12 of this report re Shanghai Composite): http://www.zerohedge.com/article/podcasting-charts-matter-next-week-technical-look-european-breakdown. This break was complety recovered and we have now seen a strong bullish engulfing candle.

Shanghai Composite Weekly:

Bullish engulfing candle just after a spillover of the trendline.

Shanghai Composite Daily:

Bottoms right on the 61.8 retrace. No follow through from the breakdown of 2650. Back to back strong bullish candles. Need 2750 to break to upside to get this bear squueze really fueling.

Hang Seng Daily i:

Looked like a breakdown of the range but....

Hang Seng Daily ii

.....there was no follow through. Shown this a few times of late. We have a A=C complete move lower i.e. a low turning point, price hit and reversed right out of the low end of the channel, and price is now testing the 22k breakdown zone. Look for breakout trades above 22k.

India Daily:

My original consolidation pattern months back did not lead to a breakout. Price was capped by the downward sloping trendline.

India Daily ii:

However, price has now tested and held the previous lows with a strong double bottom pattern in place. I tweeted about this zone during the week. Speaking of failed breakdowns, this also looks like a huge failed breakdown of a multi month triangle pattern. Price has recaptured the upward sloping trendline with a very strong reversal candle.

Nikkei Daily:

Price failed to breakdown through 9400. Now seeing a good breakout of the wedge pattern and looking for a retest of 10,000

Singapore Daily:

Broad consolidation pattern still intact. Price tested and held low end of trendline. Look for breakout of this recent range for a strong thrust higher

Like ever, being flexible and heeding price action are the key skillsets for successful trading. Hopefully some of these patterns and updates illustrate this. Good luck

Austin

I had a question the other day from a reader who wanted an update on the Chinese and Indian markets. In the past, I had shown broad consolidation patterns for both these regional powerhouses and now is an opportune time to update.

I put out a post the other day on the most important rule in technical analysis: http://swingtradersedge.blogspot.com/2011/06/most-important-rule-in-chart-analysis.html. I wrote this to try and illustrate the weaknesses in "classic" technical patterns that most of the market look at, and to try and prepare myself for a possible bullish reversal when all was looking doom and gloom. Obviously I had no idea if these patterns would fail but my experience has taught me to be very wary in such situations. My central point is- if a market fails to follow in the direction of a trading signal and pattern, it is a strong indication of a strong reversal in the opposite direction. I believe we are now seeing this reversal in the Shanghai Composite, the Hang Seng and the Nikkei. Other regional indices are also holding key zones. It is obviously still very early days and US indices are hardly looking rosy. However, I like these risk/reward setups in the short term.

Firstly, to China. There was a close below the big weekly triangle pattern that brought the bears out. It is at these times that fear hits a fever pitch as shown in some of these posts: http://www.zerohedge.com/article/chinese-1-and-2-week-shibor-rates-surge-over-9-highest-2007 and the mighty Goldman Sachs head technical analyst (go to page 12 of this report re Shanghai Composite): http://www.zerohedge.com/article/podcasting-charts-matter-next-week-technical-look-european-breakdown. This break was complety recovered and we have now seen a strong bullish engulfing candle.

Shanghai Composite Weekly:

Bullish engulfing candle just after a spillover of the trendline.

Shanghai Composite Daily:

Bottoms right on the 61.8 retrace. No follow through from the breakdown of 2650. Back to back strong bullish candles. Need 2750 to break to upside to get this bear squueze really fueling.

Hang Seng Daily i:

Looked like a breakdown of the range but....

Hang Seng Daily ii

.....there was no follow through. Shown this a few times of late. We have a A=C complete move lower i.e. a low turning point, price hit and reversed right out of the low end of the channel, and price is now testing the 22k breakdown zone. Look for breakout trades above 22k.

India Daily:

My original consolidation pattern months back did not lead to a breakout. Price was capped by the downward sloping trendline.

India Daily ii:

However, price has now tested and held the previous lows with a strong double bottom pattern in place. I tweeted about this zone during the week. Speaking of failed breakdowns, this also looks like a huge failed breakdown of a multi month triangle pattern. Price has recaptured the upward sloping trendline with a very strong reversal candle.

Nikkei Daily:

Price failed to breakdown through 9400. Now seeing a good breakout of the wedge pattern and looking for a retest of 10,000

Singapore Daily:

Broad consolidation pattern still intact. Price tested and held low end of trendline. Look for breakout of this recent range for a strong thrust higher

Like ever, being flexible and heeding price action are the key skillsets for successful trading. Hopefully some of these patterns and updates illustrate this. Good luck

Austin

Sunday 26 June 2011

A Topping Pattern Anyone?

Happy Weekend All,

I bring rather bad news in tonight's post. I think the Australian market has topped. I have been pouring over the weekly charts of some of the major stocks of late and the technical situation from a big picture perspective is real bearish indeed. All rather sobering charts so perhaps now is the time to pour yourself a scotch as you read this.

I must stress from the outset that these are WEEKLY patterns and thus perhaps not immediately actionable for many traders. I have been saying for a while that I think a short term tradeable low is forming and I still believe this may be possible. The simple fact that I am writing this now may be indicative of peak bearish sentiment i.e the worst time to be short. However, if my read on these charts is correct, as we draw to the end of the summer you will want to really be getting out of this market. It feels a lot like 2007 and drawing on experience is paramount. To reiterate where I think we are at in the more immediate short term, pls read this: http://swingtradersedge.blogspot.com/2011/06/party-like-its-2007.html

And so to the big powerhouse of the Australian market, BHP. The resource major has formed a huge Double Top pattern. The inability to break its previous highs should be viewed as an indication of a major trend reversal.

BHP Weekly:

Double Top at 50. A nice area and number for a major topping pattern. Note the weekly trendline break

If you want an example or a reminder of what happens out of these kind of ending patterns, look no further than the S&P 500.

S&P 500 Weekly:

Double top and then major trend reversal. No doubt the 2007 top took time to build but all the warning signs were there.

BHP Daily:

Back to BHP and in the short term we are testing support. I still think there is the possibility of a good bounce out of here. Should this materialise, we could also be looking at a possible Head and Shoulders top.

NCM Weekly:

Another major materials stock. Another Double Top pattern. Note the 3 wave push into the recent high

FMG Daily:

Looking like a Head and Shoulder top is forming here

WOR Weekly

Double Top pattern and shorter term rounding top. Really ugly weekly chart

The energy sector is not looking particularly healthy either.

STO Weekly:

Santos has formed a major top pattern. Price is testing the low end of the range in short term but I would view good bounces as a great time to get out or short this stock

WPL Daily:

A test and failure to break higher. Major topping reversal candle. Testing low end of range for now

OSH Weekly

Failed breakout and now a head and shoulders top is forming.

Finanical stocks are not looking too healthy either.

CBA Daily:

CBA tried to break out of a multi month consolidation pattern and failed spectacularly. Note that price topped right on the 61.8 fib retracement. If 49/48 breaks to the downside, I could see a move right back down to 40.

ANZ Daily:

Double or triple top? Call it what you want, it cant break higher

How is tech looking?

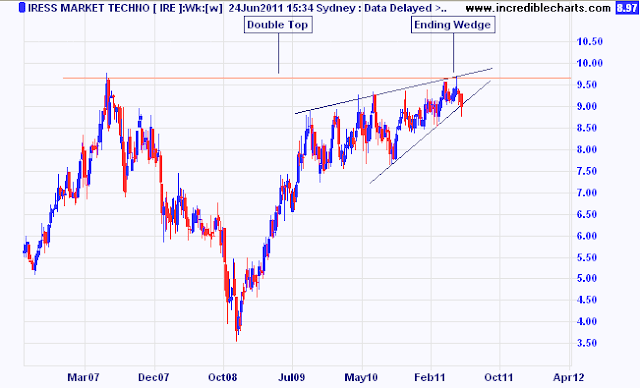

IRE Weekly:

Not so good. Look out below when this ending diagonal breaks.

You know a market is in trouble when even the defensives look like they have topped.

CCL Weekly:

Coca Cola Amatil has formed an ending wedge and possible double top

COH Weekly:

Double top and ending wedge. This shows what happens when these wedges break- price falls hard and fast.

This is the one chart that really scares me. In fact, this really could be the last shoe to drop and is indicative of the final hoorah

ILU Daily:

Do you want to hold a stock that is almost vertical? Sure I could change to log but seriously, this is absurd. I just don't see how this stock can keep up this velocity. This is a bubble

Silver Daily:

Want to see what happens to a market that is vertical- it finally implodes in ghastly fashion.

I could pull up more but I think you get the message. The big picture in Australia looks horrible. I would be using any good bounces over the next month into August to be getting firmly out of this market and hoarding up. Hopefully I can guide you through and offer helpful suggestions as this plays out. These are topping patterns and if my work is worth anything, then this message should be heeded.

Thanks

Austin

I bring rather bad news in tonight's post. I think the Australian market has topped. I have been pouring over the weekly charts of some of the major stocks of late and the technical situation from a big picture perspective is real bearish indeed. All rather sobering charts so perhaps now is the time to pour yourself a scotch as you read this.

I must stress from the outset that these are WEEKLY patterns and thus perhaps not immediately actionable for many traders. I have been saying for a while that I think a short term tradeable low is forming and I still believe this may be possible. The simple fact that I am writing this now may be indicative of peak bearish sentiment i.e the worst time to be short. However, if my read on these charts is correct, as we draw to the end of the summer you will want to really be getting out of this market. It feels a lot like 2007 and drawing on experience is paramount. To reiterate where I think we are at in the more immediate short term, pls read this: http://swingtradersedge.blogspot.com/2011/06/party-like-its-2007.html

And so to the big powerhouse of the Australian market, BHP. The resource major has formed a huge Double Top pattern. The inability to break its previous highs should be viewed as an indication of a major trend reversal.

BHP Weekly:

Double Top at 50. A nice area and number for a major topping pattern. Note the weekly trendline break

If you want an example or a reminder of what happens out of these kind of ending patterns, look no further than the S&P 500.

S&P 500 Weekly:

Double top and then major trend reversal. No doubt the 2007 top took time to build but all the warning signs were there.

BHP Daily:

Back to BHP and in the short term we are testing support. I still think there is the possibility of a good bounce out of here. Should this materialise, we could also be looking at a possible Head and Shoulders top.

NCM Weekly:

Another major materials stock. Another Double Top pattern. Note the 3 wave push into the recent high

FMG Daily:

Looking like a Head and Shoulder top is forming here

WOR Weekly

Double Top pattern and shorter term rounding top. Really ugly weekly chart

The energy sector is not looking particularly healthy either.

STO Weekly:

Santos has formed a major top pattern. Price is testing the low end of the range in short term but I would view good bounces as a great time to get out or short this stock

WPL Daily:

A test and failure to break higher. Major topping reversal candle. Testing low end of range for now

OSH Weekly

Failed breakout and now a head and shoulders top is forming.

Finanical stocks are not looking too healthy either.

CBA Daily:

CBA tried to break out of a multi month consolidation pattern and failed spectacularly. Note that price topped right on the 61.8 fib retracement. If 49/48 breaks to the downside, I could see a move right back down to 40.

ANZ Daily:

Double or triple top? Call it what you want, it cant break higher

How is tech looking?

IRE Weekly:

Not so good. Look out below when this ending diagonal breaks.

You know a market is in trouble when even the defensives look like they have topped.

CCL Weekly:

Coca Cola Amatil has formed an ending wedge and possible double top

COH Weekly:

Double top and ending wedge. This shows what happens when these wedges break- price falls hard and fast.

This is the one chart that really scares me. In fact, this really could be the last shoe to drop and is indicative of the final hoorah

ILU Daily:

Do you want to hold a stock that is almost vertical? Sure I could change to log but seriously, this is absurd. I just don't see how this stock can keep up this velocity. This is a bubble

Silver Daily:

Want to see what happens to a market that is vertical- it finally implodes in ghastly fashion.

I could pull up more but I think you get the message. The big picture in Australia looks horrible. I would be using any good bounces over the next month into August to be getting firmly out of this market and hoarding up. Hopefully I can guide you through and offer helpful suggestions as this plays out. These are topping patterns and if my work is worth anything, then this message should be heeded.

Thanks

Austin

Friday 24 June 2011

Hammer Time

Morning All,

A volatile session last night that resulted in a test of the recent lows and a strong bullish reversal. Bullish hammers have been left in a number of markets such as the S&P500, Nasdaq 100, AUDUSD and EURUSD. Rarely do you get a "clean" market bottom and I feel that last nights action is indicative of base building with the bulls coming out on top. We saw this kind of back and forth action at the July, August and November 2010 lows. No doubt I was worried as I hit the hay stacks last night but ultimately it is fear and panic that creates genuine market lows and turning points. I received 2 emails PRE US MARKET OPEN from supposed prominent technicians warning about pending disaster etc and there was a frenzy at the usual bear blogs (386 comments at Danerics "Eminis update"- no offence meant, just an observation). Seems to me these are the correct sentiment conditions for the bear squeeze to now get properly underway and confirm my technical outlook.

I try to focus on Asian setups and technicals. However, given last night's action, I feel it is very important to highlight a number of overseas markets.

S&P500:

Very wide ranging candle and test of the previous lows. Bulls came out on top with a bullish hammer left. I love to get long on close having seen these kind of candles. A clear range has now been established from 1260 to 1295/1300 so look for breaks of either for full confirmation.

Nasdaq 100:

A bullish engulfing candle left right at support. Who better to lead the charge than the high beta tech sector. This looks like a strong base pattern to me. Note that the low was formed on a perfect 100% extension of the previous wave down. Buy more if/when resistance breaks

S&P500 Daily:

This chart shows some of the lows that formed over the past year or so. Note that there is often a period of back and forth trading before a genuine breakout ensues.

AUDUSD

On Twitter last night I said "that 1.06/1.0650 level is stiff res. Buying support at 1.05 and 1.045, selling below". The 1.045 level worked like a treat with a strong bullish reversal. Only if price breaks above 1.065 now would I deem a good low in place

EURUSD

This is clearly a 3 wave move down from the recent 1.47 high. To me this implies this is a corrective pattern and NOT the beginning of a genuine breakdown for now. Looking like a triangle similar to AUDUSD.

What does this mean for Australia today? Price tested the previous lows overnight at 4435 and held in a strong double bottom play. We are set to open at 4485 which is right in the middle of the recent range thus no obvious trade here. Support is 4450 with resistance at 4495/4500 and then 4525. I will looking to join this overnight bounce out of the right level to see if there is any continuation. If there is no bearish reversal candles out of those resistance levels cited, look for breakout trades after the first 30mins and hold to the close. Ill update on twitter throughout the day.

Bigger picture we will have a confirmed short term trend change if price can trade above 4555 i.e. High, higher low, then new high. See chart below

XJO Daily:

In sum, I believe we saw an unsuccessful breakdown attempt last night in overseas markets. I have been leaning bullish here the last few days and I believe there is enough evidence in place to confirm a strong tradeable low. 1295/1300 seems to be a formidable barrier so look for this to break to add to inital positions. Friday trading is often a lottery but look for 4495 and 4500 in Australia to break for more momentum higher.

Thanks

Austin

A volatile session last night that resulted in a test of the recent lows and a strong bullish reversal. Bullish hammers have been left in a number of markets such as the S&P500, Nasdaq 100, AUDUSD and EURUSD. Rarely do you get a "clean" market bottom and I feel that last nights action is indicative of base building with the bulls coming out on top. We saw this kind of back and forth action at the July, August and November 2010 lows. No doubt I was worried as I hit the hay stacks last night but ultimately it is fear and panic that creates genuine market lows and turning points. I received 2 emails PRE US MARKET OPEN from supposed prominent technicians warning about pending disaster etc and there was a frenzy at the usual bear blogs (386 comments at Danerics "Eminis update"- no offence meant, just an observation). Seems to me these are the correct sentiment conditions for the bear squeeze to now get properly underway and confirm my technical outlook.

I try to focus on Asian setups and technicals. However, given last night's action, I feel it is very important to highlight a number of overseas markets.

S&P500:

Very wide ranging candle and test of the previous lows. Bulls came out on top with a bullish hammer left. I love to get long on close having seen these kind of candles. A clear range has now been established from 1260 to 1295/1300 so look for breaks of either for full confirmation.

Nasdaq 100:

A bullish engulfing candle left right at support. Who better to lead the charge than the high beta tech sector. This looks like a strong base pattern to me. Note that the low was formed on a perfect 100% extension of the previous wave down. Buy more if/when resistance breaks

S&P500 Daily:

This chart shows some of the lows that formed over the past year or so. Note that there is often a period of back and forth trading before a genuine breakout ensues.

AUDUSD

On Twitter last night I said "that 1.06/1.0650 level is stiff res. Buying support at 1.05 and 1.045, selling below". The 1.045 level worked like a treat with a strong bullish reversal. Only if price breaks above 1.065 now would I deem a good low in place

EURUSD

This is clearly a 3 wave move down from the recent 1.47 high. To me this implies this is a corrective pattern and NOT the beginning of a genuine breakdown for now. Looking like a triangle similar to AUDUSD.

What does this mean for Australia today? Price tested the previous lows overnight at 4435 and held in a strong double bottom play. We are set to open at 4485 which is right in the middle of the recent range thus no obvious trade here. Support is 4450 with resistance at 4495/4500 and then 4525. I will looking to join this overnight bounce out of the right level to see if there is any continuation. If there is no bearish reversal candles out of those resistance levels cited, look for breakout trades after the first 30mins and hold to the close. Ill update on twitter throughout the day.

Bigger picture we will have a confirmed short term trend change if price can trade above 4555 i.e. High, higher low, then new high. See chart below

XJO Daily:

In sum, I believe we saw an unsuccessful breakdown attempt last night in overseas markets. I have been leaning bullish here the last few days and I believe there is enough evidence in place to confirm a strong tradeable low. 1295/1300 seems to be a formidable barrier so look for this to break to add to inital positions. Friday trading is often a lottery but look for 4495 and 4500 in Australia to break for more momentum higher.

Thanks

Austin

Wednesday 22 June 2011

Yup, that was it

Morning All,

I am feeling pretty happy today. Great day in Sydney, I surfed with Taj Burrow the day before last (well he was in the water whilst I was out), and yes- the market is up! The market does this to us. It makes us feel happy when we are making money or when our analysis right. However, in this instance I am genuinely happy not for these reasons, but because I have been thinking like a Trader and carrying out my trading plan. This is not to gloat as I hate those guys out there who tweet endlessly about their successes and coin they are banking. For me, my true joy comes from a realisation of self improvement.

You see, I genuinely believe that the best traders are the ones that think differently from the rest. This is a quote taken straight out from "Trading in the Zone" by M.Douglas and it is so true. It took me a long while to realise this. Like many traders and technicians, I would often trade the obvious pattern with the crowd at exactly the wrong time. I would see a trend once it was already well established and often jump on board, extrapolating this well into the future. It took me a while to really develop an understanding of market structure and profiles. It also took me a long while to really understand the weaknesses in technical analysis. To take this current market as an example, technically we are in a downtrend with many topping patterns in place, we know that the end of QE2 is here thus a natural prop for the market is gone, and the sovereign debt crisis has turned very real. In short, there is not much to like. And yet, if you actually step back and look at where we are, the market is just testing the low end of the range (S&P500 and XJO). The low risk/high reward trade is to buy the panic into this zone and sell it if it drops. That is thinking like a trader. You can use confirmation rules or position sizing algorithms or whatever you like to buy into these zones, but the important part is thinking about risk/reward. Am I actually going to make money being short here or am I best off waiting, or even going long?

I showed a number of interesting stock setups yesterday illustrating this point:

http://swingtradersedge.blogspot.com/2011/06/australian-stock-setups.html. BEN, CBA, NAB, QBE, WPL, RIO are all just testing the low end of the range and support. We are seeing follow through today.

I also put up a post the day before showing the S&P500 and XJO testing the low end of their range and waiting for the bullish reversal candle: http://swingtradersedge.blogspot.com/2011/06/most-important-rule-in-chart-analysis.html. We have now seen those bullish reversal candles.

So where are we now? I think the stage is set for a strong rally in the S&P500 right up to 1325/1330 over the coming weeks. This is in line with my 2007 parallel scenario. If this does play out, that will be the genuine time to short stocks.

S&P500 2007:

I showed this chart the other day. The initial sell off out of the 2007 high was a wedge type pattern. Price tested the previous August lows and held. It was only when the rally out of this wedge pattern failed that the genuine bear market began.

S&P500 Current:

Last night we saw the breakout from the wedge pattern. Price did not get into my ideal 1250 level but neither did it in 2007. I will give price the benefit of the doubt and say that a low is in place. Look for 1295 to break for confirmation. Looking for targets to fib retrace at 1325/1330+.

XJO Daily:

Just to update the Daily chart I have been showing. Price tested and held the previous lows. I do not think we will be going up in a straight line but we will see higher prices over the coming days/weeks imho. Lots of res on the way up so keep trading the levels.

Hang Seng Index

Stage is set for a bear trap if price regains 22,000. This is the most important rule in technical analysis. Note that A=C down off the top and there is a bullish spillover at the low end of the channel.

Nikkei

This market is going to really move one way of the other and it is looking like an upside breakout back up to 10,000. Straddles or upside calls.

In sum, one days price action does not make a trend. However, I do think we are on the cusp of a significant short squeeze. There are good res levels all the way up so trade around these as we move higher. If this is following the 2007 scenario, be nimble as we do head higher. There will be lots of non-confirmations and sector rotations so stick to those markets and stocks that are actually displaying strength.

Thanks

Austin

I am feeling pretty happy today. Great day in Sydney, I surfed with Taj Burrow the day before last (well he was in the water whilst I was out), and yes- the market is up! The market does this to us. It makes us feel happy when we are making money or when our analysis right. However, in this instance I am genuinely happy not for these reasons, but because I have been thinking like a Trader and carrying out my trading plan. This is not to gloat as I hate those guys out there who tweet endlessly about their successes and coin they are banking. For me, my true joy comes from a realisation of self improvement.

You see, I genuinely believe that the best traders are the ones that think differently from the rest. This is a quote taken straight out from "Trading in the Zone" by M.Douglas and it is so true. It took me a long while to realise this. Like many traders and technicians, I would often trade the obvious pattern with the crowd at exactly the wrong time. I would see a trend once it was already well established and often jump on board, extrapolating this well into the future. It took me a while to really develop an understanding of market structure and profiles. It also took me a long while to really understand the weaknesses in technical analysis. To take this current market as an example, technically we are in a downtrend with many topping patterns in place, we know that the end of QE2 is here thus a natural prop for the market is gone, and the sovereign debt crisis has turned very real. In short, there is not much to like. And yet, if you actually step back and look at where we are, the market is just testing the low end of the range (S&P500 and XJO). The low risk/high reward trade is to buy the panic into this zone and sell it if it drops. That is thinking like a trader. You can use confirmation rules or position sizing algorithms or whatever you like to buy into these zones, but the important part is thinking about risk/reward. Am I actually going to make money being short here or am I best off waiting, or even going long?

I showed a number of interesting stock setups yesterday illustrating this point:

http://swingtradersedge.blogspot.com/2011/06/australian-stock-setups.html. BEN, CBA, NAB, QBE, WPL, RIO are all just testing the low end of the range and support. We are seeing follow through today.

I also put up a post the day before showing the S&P500 and XJO testing the low end of their range and waiting for the bullish reversal candle: http://swingtradersedge.blogspot.com/2011/06/most-important-rule-in-chart-analysis.html. We have now seen those bullish reversal candles.

So where are we now? I think the stage is set for a strong rally in the S&P500 right up to 1325/1330 over the coming weeks. This is in line with my 2007 parallel scenario. If this does play out, that will be the genuine time to short stocks.

S&P500 2007:

I showed this chart the other day. The initial sell off out of the 2007 high was a wedge type pattern. Price tested the previous August lows and held. It was only when the rally out of this wedge pattern failed that the genuine bear market began.

S&P500 Current:

Last night we saw the breakout from the wedge pattern. Price did not get into my ideal 1250 level but neither did it in 2007. I will give price the benefit of the doubt and say that a low is in place. Look for 1295 to break for confirmation. Looking for targets to fib retrace at 1325/1330+.

XJO Daily:

Just to update the Daily chart I have been showing. Price tested and held the previous lows. I do not think we will be going up in a straight line but we will see higher prices over the coming days/weeks imho. Lots of res on the way up so keep trading the levels.

Hang Seng Index

Stage is set for a bear trap if price regains 22,000. This is the most important rule in technical analysis. Note that A=C down off the top and there is a bullish spillover at the low end of the channel.

Nikkei

This market is going to really move one way of the other and it is looking like an upside breakout back up to 10,000. Straddles or upside calls.

In sum, one days price action does not make a trend. However, I do think we are on the cusp of a significant short squeeze. There are good res levels all the way up so trade around these as we move higher. If this is following the 2007 scenario, be nimble as we do head higher. There will be lots of non-confirmations and sector rotations so stick to those markets and stocks that are actually displaying strength.

Thanks

Austin

Tuesday 21 June 2011

Australian Stock Setups

Morning All,

I thought I would take a little break from my usual analysis and instead show a number of Daily setups of various Australian stocks. My primary vehicle of trading is the index futures but no doubt it pays to look at what is going on under the hood. I was inspired by the work of Rob at TradeTheTrade so a big thanks to him.

Firstly, to the index:

XJO Daily

Yesterday we saw price test the low end of the range and closed below the previous lows. Note this looks like a mirror reflection of what took place at the highs i.e. spillover and then reversal. We remain at the low end of the range and thus this is an area to be covering shorts and looking for possible long entries.

FINANCIAL STOCKS:

ANZ

20 to 20.50 looks to be the target zone. In no mans land here unless price regains 22.50 which wold be bullish.

BEN

Testing key support and low end of range here. 8.30 then 8.0 are key levels

CBA

A base pattern is being formed right here. 49 has to hold for bulls, breakout above 50.75/51.

NAB

Base is also being formed here at support. 24 key support, breakout above 25

WBC

Has been a violent sell off but price now testing low end of range. Time to cover shorts and look for possible bullish snapbacks.

QBE

Lots of panic but a great bounce out of the 16.0 support level. A nice illustration of why understanding the levels is so important. Looking for that gap to fill at 17 and then stand aside in short term.

MATERIAL STOCKS:

BHP (i)

Looks like a potential breakdown of support here. 42 to 43 resistance levels

BHP (ii)

However, given my views on the market, to me there is a genuine possibility of this being an ending pattern. Note ending wedge, bullish divergences and the 61.8 retrace comes in at 41. If price regains 42.50+ I think the stage is set for a bear trap and a move back up to 45.50/46. Would this then form a bigger Head and Shoulders pattern?

FMG

Possible triangle breakdown here back to horizontal support

RIO

Testing key 77.50/78 support level. Buy first, sell it if support drops

ENERGY STOCKS:

CTX

Smashed since breaking the H+S neckline. Price has now reached a 100% extension of this topping pattern which is first target. If 10.50 doesn't hold, this could trade as low as 9 before a more meaningful low forms.

PDN

Stand aside. Targets of 1.80 to 2.0 for this move still

WPL

Topped at 50 now coming into support at 40. Look at what happened to QBE out of a similar zone. Be prepared for a short term snapback rally. Wait for somekind of confirm before going long

CONSUMER STOCKS:

DJS

Key zone here. Looking like a potential breakdown play here if 4.0 drops. Target is 3.40/3.50. If there is no breakdown in next 2 sessions then look for long swings up to 4.60 and possibly higher

JBH

This is a potential A=C trade i.e. swing low has formed. Small base pattern building at 16 it seems. Aggressive long entry if price can regain 17.50/18.0. Breaks of 16 open up possible move down to 14.

I thought I would take a little break from my usual analysis and instead show a number of Daily setups of various Australian stocks. My primary vehicle of trading is the index futures but no doubt it pays to look at what is going on under the hood. I was inspired by the work of Rob at TradeTheTrade so a big thanks to him.

Firstly, to the index:

XJO Daily

Yesterday we saw price test the low end of the range and closed below the previous lows. Note this looks like a mirror reflection of what took place at the highs i.e. spillover and then reversal. We remain at the low end of the range and thus this is an area to be covering shorts and looking for possible long entries.

FINANCIAL STOCKS:

ANZ

20 to 20.50 looks to be the target zone. In no mans land here unless price regains 22.50 which wold be bullish.

BEN

Testing key support and low end of range here. 8.30 then 8.0 are key levels

CBA

A base pattern is being formed right here. 49 has to hold for bulls, breakout above 50.75/51.

NAB

Base is also being formed here at support. 24 key support, breakout above 25

WBC

Has been a violent sell off but price now testing low end of range. Time to cover shorts and look for possible bullish snapbacks.

QBE

Lots of panic but a great bounce out of the 16.0 support level. A nice illustration of why understanding the levels is so important. Looking for that gap to fill at 17 and then stand aside in short term.

MATERIAL STOCKS:

BHP (i)

Looks like a potential breakdown of support here. 42 to 43 resistance levels

BHP (ii)

However, given my views on the market, to me there is a genuine possibility of this being an ending pattern. Note ending wedge, bullish divergences and the 61.8 retrace comes in at 41. If price regains 42.50+ I think the stage is set for a bear trap and a move back up to 45.50/46. Would this then form a bigger Head and Shoulders pattern?

FMG

Possible triangle breakdown here back to horizontal support

RIO

Testing key 77.50/78 support level. Buy first, sell it if support drops

ENERGY STOCKS:

CTX

Smashed since breaking the H+S neckline. Price has now reached a 100% extension of this topping pattern which is first target. If 10.50 doesn't hold, this could trade as low as 9 before a more meaningful low forms.

PDN

Stand aside. Targets of 1.80 to 2.0 for this move still

WPL

Topped at 50 now coming into support at 40. Look at what happened to QBE out of a similar zone. Be prepared for a short term snapback rally. Wait for somekind of confirm before going long

CONSUMER STOCKS:

DJS

Key zone here. Looking like a potential breakdown play here if 4.0 drops. Target is 3.40/3.50. If there is no breakdown in next 2 sessions then look for long swings up to 4.60 and possibly higher

JBH

This is a potential A=C trade i.e. swing low has formed. Small base pattern building at 16 it seems. Aggressive long entry if price can regain 17.50/18.0. Breaks of 16 open up possible move down to 14.

Subscribe to:

Posts (Atom)