From the outset, nothing here is particularly new or revolutionary. Countless traders have devised strategies on opening gaps and morning breakouts most notably T.Crabel and M.Fisher. This is my take on what works for me through my own testing and experiences trading the Australian market. It is very very important to have a plan to trade these morning moves as they often set the tone for the rest of the day.

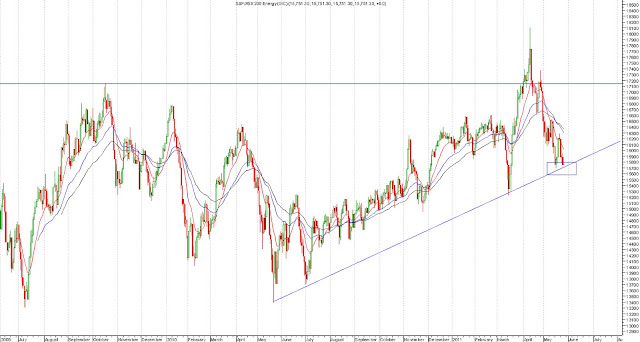

A Gap occurs when the cash session opening price is greater or lower than the previous days cash session, creating a "gap" in price levels on the chart. Given the futures markets are almost 24hrs, I always have my SPI futures chart setup to mark the beginning and end of the DAY session only to show these gaps. I switch off the night session trading which is based on a completely different set of influences. I suggest you do the same if you are an Australian Day trader.

Gaps represent emotional extremes. To me, they are so important because they tell us a lot about the upcoming market action for the day and offer great trading opportunities. A strong gap up that holds and consolidates in the morning is bullish, setting up strength for the rest of the day. Conversely, a gap up that finds little support or buying interest in the first 15mins is a candidate for a pretty sharp reversal. In essence, a gap is either going to hold or it is going to fill. Keep it simple. Have plans for trading both.

Here is today's intraday chart:

SPI June 5mins:

As per my twitter feed, I went long at 4634, sold half at 4645 (at the previous days high which was v.v. lucky) and then held rest for end of day getting out at 4655. No doubt there are areas for improvement and subsets of trading this, which is also partly the reason I write this.

The system in essence:

Entry- 2 ticks above the morning range. Range is defined by the first 3 opening candles

Stop- 8 to 10pts. Need to give it enough room without risking too much.

Exit- Hold to close. Partial out if need be.

Here is what transpired:

1) Entry- Wait for 15mins to trade and for the first 3 five minute candles to close. Note the very strong opening 5min candle today was a lead indicator of genuine strength. I then place a buy stop 2 ticks above the intraday high and a sell order to short 2 ticks below the intraday low. Filled at 4634. There was no indication at all from price that this gap was being rejected. (Some traders would like to go earlier. Again, this is what works for me).

2)Sold half at resistance- only a small initial move but I like to immediately lock in quick gains especially into yesterdays overhead highs on a partial amount. However, the key is to hold at least a partial to the close. We are aiming for a strong trend day.

3) Retracement and then 1.30pm breakout to upside once more. Aggressive traders would have seen that the 30s dropped but soon recovered. There was a small trendline break thus could have added/bought back here.

4) Break of intraday highs at 4645 setting up a strong run into the close. Add

5) Exit- let the market take you out as it moves higher into the close. This is the hardest thing to do but the KEY for success. Large range days will close at or near the high if it is an up day so you have to able to extract the most amount from this. As L.Williams says "..for short term traders, to catch a winning trade, the most profitable strategy is to hold to the close".

Thats it. This is not meant to be hindsight but a run through of a powerful and simple trading setup. Trades like this happen quite frequently in Asia given the overnight moves so you have to have a plan.

Would value any feedback, comments or questions as ever.

Austin