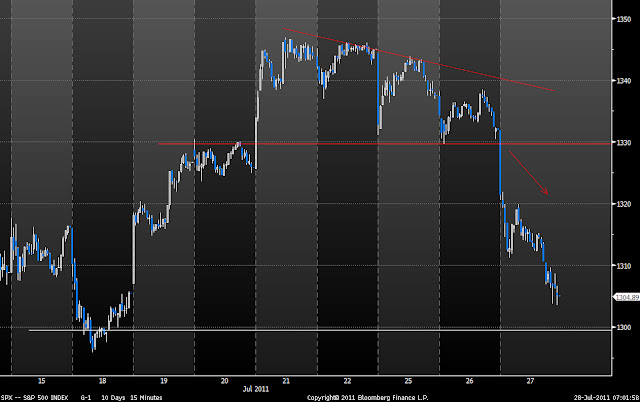

Last night we saw a small rally in the S&P500 that completely failed, and the market went on to retest its lows. I expected the market to continue the move down last night at a minimum and this played out. When a market makes a new momentum low, our highest probability trade is to sell the first pullback. That trade worked well and we are left in a position where the market can genuinely do anything. I don't know about you, but given the position of this market, and given the magnitude of the discussions that are going to take place this weekend, I am happy to have absolutely no position. Taking a major position ahead of this event is gambling, not trading.

To me, this market is tired and is showing increasing signs of distribution. Of course, there is a very real likelihood of lawmakers putting something together over the weekend resulting in a equity market rally. The key levels I am watching the S&P500 are reiterated below

S&P500 60mins:

We have key pivot level at 1296/1300 (which is also the 61.8 fib retrace off the June low), and there is a potential A=C move lower target at the 1285 level. If this market is going to hold in, it is here. I am thinking we see one more session of weakness/panic into the low end of this range and then look for hammers etc for confirmation.

Just food for thought. The market is pricing in almost ZERO chance of a default. The overwhelming consensus is that a deal of some sort will get done despite the persistent politicking. I don't necessarily disagree with this. However, given that the market is not positioned for this event, there will be genuine panic if these levels do go and if something does not happen on time. Again, we cannot know in advance thus wait don't gamble.

I received an email from a reader (nice one Erik) who suggested that a bullish "E" leg of a triangle was forming on the S&P500 Daily. I cant refute this and it would coincide with this final support zone that I am mentioning here. Personally I think this is the lower probability event but I await the price action come Tuesday.

Another Daily chart that is looking interesting to me here is the AUD Daily. I talked about this the other day and we are now seeing confirmation on the Daily of a possible Double Top trade. These are great risk reward trades and you have to be willing to be contrarian in these situations.

AUDUSD Daily:

Reversal candle right out of the resistance area. Get short and there should be immediate follow through otherwise cover.

The Australian market is hanging right on the edge here. This 4450 area have been tested on several occasions and the bounces have been anaemic. I think it is only a matter of time before this breaks.

ASX200 Daily:

India Daily:

I was concerned about false breakouts. Here is the first one in the region. Not good

UPDATE

S&P Futures are getting hit here. Panic into the 1285 support level.