Recently I have been showing some great risk/reward BUY setups in the S&P Emini 500, the Eurostoxx, AUDUSD and the ASX200: http://swingtradersedge.blogspot.com/2011/05/when-crowd-panics-keep-your-head.html AND http://swingtradersedge.blogspot.com/2011/05/let-snapback-begin.html.

I wanted to now update these setups to show how they have played out. As I write, we are now seeing strong follow through indeed. The initial entries are now over, managing the position is key.

Eurostoxx 60mins:

A strong base pattern formed, 2800 has been recaptured and we are now testing the final downward sloping resistance line after todays gap up. Look for breakout trades to add.

Emini June 60mins:

A great long entry was identified at 1310 and then above 1325. We are now seeing a strong breakout indeed. Watch the overhead previous resistance levels at 1340/45 in the short term. I think we are still going a lot higher however.

AUDUSD 60mins:

Breakout of the wedge pattern after the "E" low reversal. Bullish divergences lead the price action here.

The initial entry triggers for these patterns all occurred over the last few days. It is only now that we hear of "Greek rescue packages" and the like which add fuel to the fire. As ever, price leads and hopefully these recent posts have clearly illustrated this. Most importantly, I hope you made money.

Thanks

Austin

Twitter Feed

Tuesday, 31 May 2011

Friday, 27 May 2011

Let The Snapback Begin

Morning All,

Yesterday's morning post proved to be timely and effective: http://swingtradersedge.blogspot.com/2011/05/when-crowd-panics-keep-your-head.html. There was a strong gap up in Australia and the market built on these gains throughout the day. Scanning across my Australian charts, I believe the stage is set for a strong snapback up to 4800 and possibly beyond.

Let me just run through some of the charts I showed yesterday and update:

ASX200 Cash Daily:

Price closed outside of the lower Bollinger band highlighting a panic extreme. Yesterday we closed very strongly back within the band which gives a BUY signal according to this system. Very nice bullish reversal candle. Note all the previous occurrences over the past year or so have seen very strong rallies in the following days.

Financials Daily:

Strong bounce and wide ranging candle right off my target area. Note the completely engulfing candle. The higher degree trend is down so this is a short term long swing only

Materials Daily:

Price once again hit and respected the upward trendline. Would need some more confirmation today for me to confirm a strong low in place.

AUDUSD 30mins:

A great recovery out of the low end of the wedge pattern and the initial long entry shows some good gains. Watch this downward trendline carefully for confirmation.

SPI June 30mins:

A clear 3 wave push down lower followed by a strong initial bounce. This is one of my climatic reversal patterns and I am looking for a bounce higher back into 4800 once more and possibly beyond.

As for overseas markets, the markets that I had labelled as Good in my good, bad and ugly post, just got a bit better. http://swingtradersedge.blogspot.com/2011/05/bull-trap.html

Eurostoxx 60mins:

This is the height of the current crisis. Well this pattern looks clearly corrective to me and price has recovered the 2800 level. Price needs to now break beyond this open gap area for a clear long signal and change of trend

Emini S&P 60mins:

A great recovery out of the low end of this wedge pattern. Resistance at 1325 broke yesterday and I am now looking for a break of the downward sloping trendline to confirm a more meaningful low

In sum...buy it. Aitken probably went long on the low yesterday :)

Thanks

Austin

Yesterday's morning post proved to be timely and effective: http://swingtradersedge.blogspot.com/2011/05/when-crowd-panics-keep-your-head.html. There was a strong gap up in Australia and the market built on these gains throughout the day. Scanning across my Australian charts, I believe the stage is set for a strong snapback up to 4800 and possibly beyond.

Let me just run through some of the charts I showed yesterday and update:

ASX200 Cash Daily:

Price closed outside of the lower Bollinger band highlighting a panic extreme. Yesterday we closed very strongly back within the band which gives a BUY signal according to this system. Very nice bullish reversal candle. Note all the previous occurrences over the past year or so have seen very strong rallies in the following days.

Financials Daily:

Strong bounce and wide ranging candle right off my target area. Note the completely engulfing candle. The higher degree trend is down so this is a short term long swing only

Materials Daily:

Price once again hit and respected the upward trendline. Would need some more confirmation today for me to confirm a strong low in place.

AUDUSD 30mins:

A great recovery out of the low end of the wedge pattern and the initial long entry shows some good gains. Watch this downward trendline carefully for confirmation.

SPI June 30mins:

A clear 3 wave push down lower followed by a strong initial bounce. This is one of my climatic reversal patterns and I am looking for a bounce higher back into 4800 once more and possibly beyond.

As for overseas markets, the markets that I had labelled as Good in my good, bad and ugly post, just got a bit better. http://swingtradersedge.blogspot.com/2011/05/bull-trap.html

Eurostoxx 60mins:

This is the height of the current crisis. Well this pattern looks clearly corrective to me and price has recovered the 2800 level. Price needs to now break beyond this open gap area for a clear long signal and change of trend

Emini S&P 60mins:

A great recovery out of the low end of this wedge pattern. Resistance at 1325 broke yesterday and I am now looking for a break of the downward sloping trendline to confirm a more meaningful low

In sum...buy it. Aitken probably went long on the low yesterday :)

Thanks

Austin

Thursday, 26 May 2011

Day Trading Gaps

I thought I would write a post match analysis given that today was an ideal illustration of my morning Gap strategy. I called this out on twitter throughout the day but I thought now would be an opportune time to go through this more thoroughly. As I said the other day, I am in the process of drawing up a Day Trading programme and setups like this are an integral part of my Day Trading plan.

From the outset, nothing here is particularly new or revolutionary. Countless traders have devised strategies on opening gaps and morning breakouts most notably T.Crabel and M.Fisher. This is my take on what works for me through my own testing and experiences trading the Australian market. It is very very important to have a plan to trade these morning moves as they often set the tone for the rest of the day.

A Gap occurs when the cash session opening price is greater or lower than the previous days cash session, creating a "gap" in price levels on the chart. Given the futures markets are almost 24hrs, I always have my SPI futures chart setup to mark the beginning and end of the DAY session only to show these gaps. I switch off the night session trading which is based on a completely different set of influences. I suggest you do the same if you are an Australian Day trader.

Gaps represent emotional extremes. To me, they are so important because they tell us a lot about the upcoming market action for the day and offer great trading opportunities. A strong gap up that holds and consolidates in the morning is bullish, setting up strength for the rest of the day. Conversely, a gap up that finds little support or buying interest in the first 15mins is a candidate for a pretty sharp reversal. In essence, a gap is either going to hold or it is going to fill. Keep it simple. Have plans for trading both.

Here is today's intraday chart:

SPI June 5mins:

As per my twitter feed, I went long at 4634, sold half at 4645 (at the previous days high which was v.v. lucky) and then held rest for end of day getting out at 4655. No doubt there are areas for improvement and subsets of trading this, which is also partly the reason I write this.

The system in essence:

1) Entry- Wait for 15mins to trade and for the first 3 five minute candles to close. Note the very strong opening 5min candle today was a lead indicator of genuine strength. I then place a buy stop 2 ticks above the intraday high and a sell order to short 2 ticks below the intraday low. Filled at 4634. There was no indication at all from price that this gap was being rejected. (Some traders would like to go earlier. Again, this is what works for me).

2)Sold half at resistance- only a small initial move but I like to immediately lock in quick gains especially into yesterdays overhead highs on a partial amount. However, the key is to hold at least a partial to the close. We are aiming for a strong trend day.

3) Retracement and then 1.30pm breakout to upside once more. Aggressive traders would have seen that the 30s dropped but soon recovered. There was a small trendline break thus could have added/bought back here.

4) Break of intraday highs at 4645 setting up a strong run into the close. Add

5) Exit- let the market take you out as it moves higher into the close. This is the hardest thing to do but the KEY for success. Large range days will close at or near the high if it is an up day so you have to able to extract the most amount from this. As L.Williams says "..for short term traders, to catch a winning trade, the most profitable strategy is to hold to the close".

Thats it. This is not meant to be hindsight but a run through of a powerful and simple trading setup. Trades like this happen quite frequently in Asia given the overnight moves so you have to have a plan.

Would value any feedback, comments or questions as ever.

Austin

From the outset, nothing here is particularly new or revolutionary. Countless traders have devised strategies on opening gaps and morning breakouts most notably T.Crabel and M.Fisher. This is my take on what works for me through my own testing and experiences trading the Australian market. It is very very important to have a plan to trade these morning moves as they often set the tone for the rest of the day.

A Gap occurs when the cash session opening price is greater or lower than the previous days cash session, creating a "gap" in price levels on the chart. Given the futures markets are almost 24hrs, I always have my SPI futures chart setup to mark the beginning and end of the DAY session only to show these gaps. I switch off the night session trading which is based on a completely different set of influences. I suggest you do the same if you are an Australian Day trader.

Gaps represent emotional extremes. To me, they are so important because they tell us a lot about the upcoming market action for the day and offer great trading opportunities. A strong gap up that holds and consolidates in the morning is bullish, setting up strength for the rest of the day. Conversely, a gap up that finds little support or buying interest in the first 15mins is a candidate for a pretty sharp reversal. In essence, a gap is either going to hold or it is going to fill. Keep it simple. Have plans for trading both.

Here is today's intraday chart:

SPI June 5mins:

As per my twitter feed, I went long at 4634, sold half at 4645 (at the previous days high which was v.v. lucky) and then held rest for end of day getting out at 4655. No doubt there are areas for improvement and subsets of trading this, which is also partly the reason I write this.

The system in essence:

Entry- 2 ticks above the morning range. Range is defined by the first 3 opening candles

Stop- 8 to 10pts. Need to give it enough room without risking too much.

Exit- Hold to close. Partial out if need be.

Here is what transpired:

1) Entry- Wait for 15mins to trade and for the first 3 five minute candles to close. Note the very strong opening 5min candle today was a lead indicator of genuine strength. I then place a buy stop 2 ticks above the intraday high and a sell order to short 2 ticks below the intraday low. Filled at 4634. There was no indication at all from price that this gap was being rejected. (Some traders would like to go earlier. Again, this is what works for me).

2)Sold half at resistance- only a small initial move but I like to immediately lock in quick gains especially into yesterdays overhead highs on a partial amount. However, the key is to hold at least a partial to the close. We are aiming for a strong trend day.

3) Retracement and then 1.30pm breakout to upside once more. Aggressive traders would have seen that the 30s dropped but soon recovered. There was a small trendline break thus could have added/bought back here.

4) Break of intraday highs at 4645 setting up a strong run into the close. Add

5) Exit- let the market take you out as it moves higher into the close. This is the hardest thing to do but the KEY for success. Large range days will close at or near the high if it is an up day so you have to able to extract the most amount from this. As L.Williams says "..for short term traders, to catch a winning trade, the most profitable strategy is to hold to the close".

Thats it. This is not meant to be hindsight but a run through of a powerful and simple trading setup. Trades like this happen quite frequently in Asia given the overnight moves so you have to have a plan.

Would value any feedback, comments or questions as ever.

Austin

When the crowd panics, keep your head

Morning All,

On the twitter feed yesterday, there seemed to be A LOT of panic and all the charts that were posted were forecasting huge breakdowns, iii of 3 downs, crash etc. I picked up on particular comment where an astute trader said "IMO everything is looking cataclysmic to me". Now I am not trying to be a hero as picking a bottom is fraught with danger and some of these points raised were very valid. However, the important thing to gauge from this is that in these situations, it is very very likely that the crowd and the market will be FEELING exactly the same. Everybody is looking at the same charts and the collective social mood will be wrapped up in this bearish mentality. This is the worst time to trade. In fact, these are the exact moments when you have to be prepared to do the uncomfortable and fade the crowd. Sure enough there was quite a sharp snap back last night. I believe there is a genuine possibility of a bear squeeze to come.

No doubt I tried to call on a turn on the 16th May and this was short lived: http://swingtradersedge.blogspot.com/2011/05/turning-point.html. However, by identifying low risk opportunities with the correct stops, no damage is or was done.

The S&P Emini futures did break the wedge type pattern I posted yesterday during Asian hours. However, there was a very strong recovery and the downward trendline was recaptured. This is indicative of a solid bear trap. Note also that there are Fibonacci relationships in place between the waves that indicate the end of this corrective pattern. More confirmation is needed but I like this as a low risk trading opportunity. That is what we do as swing traders- keep identifying low risk areas to get into the trend. We never know which one will play out but the winners will far outweigh these small loses as long as you are obeying the stops.

Emini S&P 60mins:

Interestingly, AUD also manged to recapture the downward sloping trendline I had in place. This could be irregular type triangle or a wedge pattern. No matter, we now have a failed breakdown, a bullish inital price reversal, momentum divergences in place and a clear corrective pattern. Low risk entry here or wait for price to clear the downward trendline.

AUDUSD 60mins:

I thought I would quickly show the Australian Sector indices as they are coming into some very interesting areas of support.

Materials Sector Daily:

2 Signifcant trendlines coming in here

Materials Sector Daily Zoomed in:

Financials Sector Daily:

This sector does look rather weak with a lower high in place and a strong thrust lower. However, we are now approaching the low end of the range and a 61.8 fib retracement. Time for a pause and possibly look to buy oversold names on confirmation for a short term swing only.

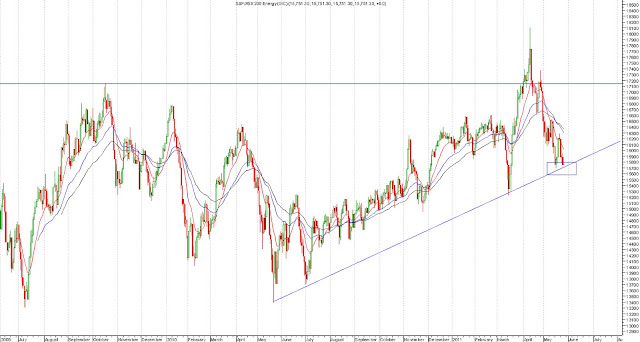

Energy Sector Daily:

ASX200 Cash Daily:

I find this chart very interesting indeed. Firstly, the market is approaching an upward sloping trendline and natural area of support/the low end of the range. This is not the time to be initiating new shorts Furthermore, I have overlaid some simple bollinger bands over the price action (2 Standard Deviations). As you can see, when price closes or trades sharply out of the lower end of the bands, there is a strong buy signal once price closes back into the band. This represents panic as the market loses its head and the rubber band snapsback. We are approaching a similar juncture.

Certainly, this kind of market action across asset classes calls for ALL traders to be incredibly nimble and careful. Don't get married to a position for too long. However, I do believe we are seeing an emotional extreme in the market place which offers yet another great risk/reward buying opportunity. Some markets look quite horrible (most notably China) thus I am certainly not forecasting a strong impulsive move back up to the highs yet. However, being a trader is all about identifying low risk/high reward setups. This is another one of those opportunities soon I believe.

Thanks

Austin

On the twitter feed yesterday, there seemed to be A LOT of panic and all the charts that were posted were forecasting huge breakdowns, iii of 3 downs, crash etc. I picked up on particular comment where an astute trader said "IMO everything is looking cataclysmic to me". Now I am not trying to be a hero as picking a bottom is fraught with danger and some of these points raised were very valid. However, the important thing to gauge from this is that in these situations, it is very very likely that the crowd and the market will be FEELING exactly the same. Everybody is looking at the same charts and the collective social mood will be wrapped up in this bearish mentality. This is the worst time to trade. In fact, these are the exact moments when you have to be prepared to do the uncomfortable and fade the crowd. Sure enough there was quite a sharp snap back last night. I believe there is a genuine possibility of a bear squeeze to come.

No doubt I tried to call on a turn on the 16th May and this was short lived: http://swingtradersedge.blogspot.com/2011/05/turning-point.html. However, by identifying low risk opportunities with the correct stops, no damage is or was done.

The S&P Emini futures did break the wedge type pattern I posted yesterday during Asian hours. However, there was a very strong recovery and the downward trendline was recaptured. This is indicative of a solid bear trap. Note also that there are Fibonacci relationships in place between the waves that indicate the end of this corrective pattern. More confirmation is needed but I like this as a low risk trading opportunity. That is what we do as swing traders- keep identifying low risk areas to get into the trend. We never know which one will play out but the winners will far outweigh these small loses as long as you are obeying the stops.

Emini S&P 60mins:

Interestingly, AUD also manged to recapture the downward sloping trendline I had in place. This could be irregular type triangle or a wedge pattern. No matter, we now have a failed breakdown, a bullish inital price reversal, momentum divergences in place and a clear corrective pattern. Low risk entry here or wait for price to clear the downward trendline.

AUDUSD 60mins:

I thought I would quickly show the Australian Sector indices as they are coming into some very interesting areas of support.

Materials Sector Daily:

2 Signifcant trendlines coming in here

Materials Sector Daily Zoomed in:

Financials Sector Daily:

This sector does look rather weak with a lower high in place and a strong thrust lower. However, we are now approaching the low end of the range and a 61.8 fib retracement. Time for a pause and possibly look to buy oversold names on confirmation for a short term swing only.

Energy Sector Daily:

ASX200 Cash Daily:

I find this chart very interesting indeed. Firstly, the market is approaching an upward sloping trendline and natural area of support/the low end of the range. This is not the time to be initiating new shorts Furthermore, I have overlaid some simple bollinger bands over the price action (2 Standard Deviations). As you can see, when price closes or trades sharply out of the lower end of the bands, there is a strong buy signal once price closes back into the band. This represents panic as the market loses its head and the rubber band snapsback. We are approaching a similar juncture.

Certainly, this kind of market action across asset classes calls for ALL traders to be incredibly nimble and careful. Don't get married to a position for too long. However, I do believe we are seeing an emotional extreme in the market place which offers yet another great risk/reward buying opportunity. Some markets look quite horrible (most notably China) thus I am certainly not forecasting a strong impulsive move back up to the highs yet. However, being a trader is all about identifying low risk/high reward setups. This is another one of those opportunities soon I believe.

Thanks

Austin

Wednesday, 25 May 2011

Day Trading the SPI

A lot of my trading energy of late has been spent day trading the SPI on the SFE (ASX200 futures). I have been registering some really good results of late and I am in the process of writing up a more thorough Day Trading programme for trading this market. This is not just a programme covering trading setups but encompasses the characteristics of our market and the essential skills needed. I think this will be of great interest to many readers here and those on the convore chatroom who are day trading Australian stocks. I genuinely believe that successful trading is all about skill development, having a back tested trading plan, and discipline. This is even more apparent in Day Trading which requires a very particular skillset. It is my hope that my programme builds on all these areas and will be of great value not just to myself, but for others.

I do gain a lot of inspiration from the works and teachings of SMB Capital, a proprietary trading firm in the US that is a real pioneer in trading development and education. Why can't this model be replicated here in Australia? It certainly can. I write this blog to offer educational material and I hope to take these initial steps even further. Yesterday was a great trading day in the SPI. I called out some of these setups on twitter and missed others. As ever, I find so much value at the end of the day from studying my recorded video via Casmasta and the charts. Look at this 2min chart below and ask yourself how many of these setups are in your trading repertoire? When you combine these setups with strong trading skills and the ability to read the order book, you are on your way for a truly profitable trading career.

SPI 2mins:

1) Fading the morning gap down- these trades play on the herd behavior and panic. Target is yesterdays close i.e. the open gap.

2) Joining the downtrend to get short- the morning rally ran out of steam at the moving averages. Note the bearish reversal candle right at the gap target. Short as supports break. Higher timeframe trend is firmly down (see 60mins chart)

3) Cover short at previous intraday low- possible low risk Long at these level? Stopped out

4) Buy major support- the SPI is always defended at the round numbers. I called out size on the bid at 4601 and 4600. A real low risk play

5) Breakout play- strong thrust off 4600 with a higher low formed. Buy as price makes a new high thus defining a new uptrend. I called out big offers at the lows 20s- once they lifted we were off back to the 40s.

SPI 60mins Downtrend:

Thanks

Austin

I do gain a lot of inspiration from the works and teachings of SMB Capital, a proprietary trading firm in the US that is a real pioneer in trading development and education. Why can't this model be replicated here in Australia? It certainly can. I write this blog to offer educational material and I hope to take these initial steps even further. Yesterday was a great trading day in the SPI. I called out some of these setups on twitter and missed others. As ever, I find so much value at the end of the day from studying my recorded video via Casmasta and the charts. Look at this 2min chart below and ask yourself how many of these setups are in your trading repertoire? When you combine these setups with strong trading skills and the ability to read the order book, you are on your way for a truly profitable trading career.

SPI 2mins:

1) Fading the morning gap down- these trades play on the herd behavior and panic. Target is yesterdays close i.e. the open gap.

2) Joining the downtrend to get short- the morning rally ran out of steam at the moving averages. Note the bearish reversal candle right at the gap target. Short as supports break. Higher timeframe trend is firmly down (see 60mins chart)

3) Cover short at previous intraday low- possible low risk Long at these level? Stopped out

4) Buy major support- the SPI is always defended at the round numbers. I called out size on the bid at 4601 and 4600. A real low risk play

5) Breakout play- strong thrust off 4600 with a higher low formed. Buy as price makes a new high thus defining a new uptrend. I called out big offers at the lows 20s- once they lifted we were off back to the 40s.

SPI 60mins Downtrend:

Thanks

Austin

Tuesday, 24 May 2011

S&P 500 Emini

Seeing a small recovery here in Asia today and the Eminis are holding the previous low of the 18th May at 1316. This pattern here does not look like a bearish breakdown currently. Bear this pattern in mind

Emini 60mins:

This looks like a corrective pattern to me off the May highs and not the beginning of a serious impulsive breakdown. 1315 appears to be a key pivot and looking for a strong recovery off here to confirm.

Emini 60mins:

This looks like a corrective pattern to me off the May highs and not the beginning of a serious impulsive breakdown. 1315 appears to be a key pivot and looking for a strong recovery off here to confirm.

Bull Trap?

Morning All,

The barrage of weekend headlines certainly appears to have dented this bottoming process and puts a number of scenarios in jeopardy. I expressed this concern in my "Hmmmm" post yesterday morning. As I scan across various markets, some appear to be holding on by a thread whilst others clearly offer great short setups. I am always dubious of making any strong conclusions on a Monday as these trading days are always exaggerated by weekend news flow and the like. We will see today if this is a genuine breakdown or a stepping process lower.

I thought I would keep this update simple by showing the good, the bad and the ugly.

The Good (well not that good)

S&P 500 Daily:

This market has traded right into the Daily trendline and low end of support. I am sure there are many out there who will be looking at this as a buying opportunity. If we see a bullish closing candle out of here, it would setup a "retracement" trade for many dip buyers.

S&P 500 60mins:

The market never managed to break above the downward trendline I talked about. My initial call at 1325/1320 was a good one but there was no follow through above that trendline. Yesterdays breadth was bearish with a 90% down day registered, but note volume was very low and there was no real intraday movement other than during the open. This could still be a corrective move lower with an ABC down complete, followed by an X up with the final waves unfolding here. That is hugely speculative but I have also seen the usual suspects now calling this a series of 1s and 2s down- my favourite fadeable Elliott count setup.

Eurostoxx 60mins:

The current market concerns are all about Europe and the EUR. However, the Eurostoxx doesn't appear to be breaking down impulsively. In fact, this could be seen as a wedge type pattern. Still early days no doubt but if the market can regain 2800 and the open gap with strength, I think this is a good long setup.

The Bad

ASX200 Cash 60mins

No follow through from the ending wedge pattern on the 60mins setting up a bull trap. However, are we looking at the final 5th wave down? I do not know but the market tried to bounce out of 4650 and failed spectacularly. Day trading this market has been great, swing trading a nightmare.

AUDUSD 60mins:

Holding...just. The final stages of an "e" leg or about to breakdown? I don't have much conviction unless that downward sloping trendline breaks to the upside.

The Ugly:

Shanghai Composite Daily:

That is a strong down day breaking through good support and the recent base building. I have showed this chart countless times and this was my do or die area- well looks like it died. I would only consider this on the long side if yesterdays highs get taken out. I talked about consolidation patterns a week back- this consolidation pattern has ended

MSCI Singapore Daily:

Attempted breakout and failure. Strong down candle yesterday, looking for lower prices

EURUSD Daily:

Breaks of 1.40 open up lower prices to 1.35 possibly. This is my biggest concern for the market

In sum, there are dislocations everywhere and unless the market can stage a herculean rebound today, I think we may be set for a tough time. At first glance, it seems that the market has been caught long trying to pick a low. Any more weakness will open up some genuine selling. Stick to the clearest setups and the plan- don't let the emotions get to you in these volatile markets especially in no man's land.

Thanks

Austin

The barrage of weekend headlines certainly appears to have dented this bottoming process and puts a number of scenarios in jeopardy. I expressed this concern in my "Hmmmm" post yesterday morning. As I scan across various markets, some appear to be holding on by a thread whilst others clearly offer great short setups. I am always dubious of making any strong conclusions on a Monday as these trading days are always exaggerated by weekend news flow and the like. We will see today if this is a genuine breakdown or a stepping process lower.

I thought I would keep this update simple by showing the good, the bad and the ugly.

The Good (well not that good)

S&P 500 Daily:

This market has traded right into the Daily trendline and low end of support. I am sure there are many out there who will be looking at this as a buying opportunity. If we see a bullish closing candle out of here, it would setup a "retracement" trade for many dip buyers.

S&P 500 60mins:

The market never managed to break above the downward trendline I talked about. My initial call at 1325/1320 was a good one but there was no follow through above that trendline. Yesterdays breadth was bearish with a 90% down day registered, but note volume was very low and there was no real intraday movement other than during the open. This could still be a corrective move lower with an ABC down complete, followed by an X up with the final waves unfolding here. That is hugely speculative but I have also seen the usual suspects now calling this a series of 1s and 2s down- my favourite fadeable Elliott count setup.

Eurostoxx 60mins:

The current market concerns are all about Europe and the EUR. However, the Eurostoxx doesn't appear to be breaking down impulsively. In fact, this could be seen as a wedge type pattern. Still early days no doubt but if the market can regain 2800 and the open gap with strength, I think this is a good long setup.

The Bad

ASX200 Cash 60mins

No follow through from the ending wedge pattern on the 60mins setting up a bull trap. However, are we looking at the final 5th wave down? I do not know but the market tried to bounce out of 4650 and failed spectacularly. Day trading this market has been great, swing trading a nightmare.

AUDUSD 60mins:

Holding...just. The final stages of an "e" leg or about to breakdown? I don't have much conviction unless that downward sloping trendline breaks to the upside.

The Ugly:

Shanghai Composite Daily:

That is a strong down day breaking through good support and the recent base building. I have showed this chart countless times and this was my do or die area- well looks like it died. I would only consider this on the long side if yesterdays highs get taken out. I talked about consolidation patterns a week back- this consolidation pattern has ended

MSCI Singapore Daily:

Attempted breakout and failure. Strong down candle yesterday, looking for lower prices

EURUSD Daily:

Breaks of 1.40 open up lower prices to 1.35 possibly. This is my biggest concern for the market

In sum, there are dislocations everywhere and unless the market can stage a herculean rebound today, I think we may be set for a tough time. At first glance, it seems that the market has been caught long trying to pick a low. Any more weakness will open up some genuine selling. Stick to the clearest setups and the plan- don't let the emotions get to you in these volatile markets especially in no man's land.

Thanks

Austin

Monday, 23 May 2011

Hmmmmm

Morning All,

For those of you who enjoy their reading, John Mauldin's latest on the unfolding EUR crisis is a must: http://www.johnmauldin.com/images/uploads/pdf/mwo052011.pdf. I hope to do a summary of this piece today and offer my own thoughts. Some of this is grim reading indeed and the contrarian in me wants to view this as a timely reminder that a low may be forming. However, no doubt there are many very real and valid points in this argument that will come home to roost. At some point, the markets will say enough is enough. We just don't know when that point is.

One of the main reasons I have always used charts as my primary trading tool, is that they offer a complete summary of price action and what the market is actually doing. The breakup of Europe (or the ejection of certain member states) may be a very solid fundamental argument indeed but you can't time the markets using this. You have to wait for the market to confirm your scenario. I have been calling for a potential bullish turning point based on some strong areas of support holding and some initial price confirmation, but we are now very close to this being invalidated. The next 2 days will be key. It is one of those horrible binary moments as a analyst and trader where all I can say is if it holds we are going higher, if it breaks get short.

EUR Daily:

I showed the pitchfork in my FX summary last week. The low end of this channel must hold otherwise we could be looking at a steep decline indeed. Note that we have seen a bearish break of a small flag pattern on the Daily. This action looks eerily similar to November 2010 where the EUR fell from 1.43 to 1.30 in a sharp ABC move down where A=C on the low. If the market breaks here, we are looking at a possible move down to 1.35 based on the same pattern and relationships.

EUR 60mins:

No real follow through from my ending bullish pattern. A clear range has been established now from 1.40/1.405 to 1.43. Trade the range and if the low end breaks, get short targeting 1.35.

AUDUSD 60mins:

The triangle pattern that I postulated is still playing out. Need to see the 1.055 level hold and a break of the downward trendline.

SPI 15mins:

The SPI is set to open at around 4700, a 40pt drop from Friday's close. There is a big area of support from 4690 to 4705 based on an open gap, fib relationships, and the psych 4700 level. I am buying support first, shorting below. Keep it simple.

XJO Cash 60mins:

Breakout of the Ending wedge pattern is still in play. However, the market must hold in the next 2 sessions to keep this valid.

Copper June Daily:

Copper has always been a strong benchmark for risk appetite. We have an A=C retracement pattern in play and a failed breakdown through 4.0. A solid close back above 4.10 would be a strong long signal. However, I am certainly weary of a potential bearish flag here thus we need to see follow through promptly.

In sum, in bull markets you keep buying supports until they drop. Have we reached a point now where the market is telling us enough is enough? It is still early but the market needs to quickly recover and hold support for me to keep my conviction. I am sure the market is focusing on the EUR very intently indeed, so keep those levels on your radar.

Good Luck

For those of you who enjoy their reading, John Mauldin's latest on the unfolding EUR crisis is a must: http://www.johnmauldin.com/images/uploads/pdf/mwo052011.pdf. I hope to do a summary of this piece today and offer my own thoughts. Some of this is grim reading indeed and the contrarian in me wants to view this as a timely reminder that a low may be forming. However, no doubt there are many very real and valid points in this argument that will come home to roost. At some point, the markets will say enough is enough. We just don't know when that point is.

One of the main reasons I have always used charts as my primary trading tool, is that they offer a complete summary of price action and what the market is actually doing. The breakup of Europe (or the ejection of certain member states) may be a very solid fundamental argument indeed but you can't time the markets using this. You have to wait for the market to confirm your scenario. I have been calling for a potential bullish turning point based on some strong areas of support holding and some initial price confirmation, but we are now very close to this being invalidated. The next 2 days will be key. It is one of those horrible binary moments as a analyst and trader where all I can say is if it holds we are going higher, if it breaks get short.

EUR Daily:

I showed the pitchfork in my FX summary last week. The low end of this channel must hold otherwise we could be looking at a steep decline indeed. Note that we have seen a bearish break of a small flag pattern on the Daily. This action looks eerily similar to November 2010 where the EUR fell from 1.43 to 1.30 in a sharp ABC move down where A=C on the low. If the market breaks here, we are looking at a possible move down to 1.35 based on the same pattern and relationships.

EUR 60mins:

No real follow through from my ending bullish pattern. A clear range has been established now from 1.40/1.405 to 1.43. Trade the range and if the low end breaks, get short targeting 1.35.

AUDUSD 60mins:

The triangle pattern that I postulated is still playing out. Need to see the 1.055 level hold and a break of the downward trendline.

SPI 15mins:

The SPI is set to open at around 4700, a 40pt drop from Friday's close. There is a big area of support from 4690 to 4705 based on an open gap, fib relationships, and the psych 4700 level. I am buying support first, shorting below. Keep it simple.

XJO Cash 60mins:

Breakout of the Ending wedge pattern is still in play. However, the market must hold in the next 2 sessions to keep this valid.

Copper June Daily:

Copper has always been a strong benchmark for risk appetite. We have an A=C retracement pattern in play and a failed breakdown through 4.0. A solid close back above 4.10 would be a strong long signal. However, I am certainly weary of a potential bearish flag here thus we need to see follow through promptly.

In sum, in bull markets you keep buying supports until they drop. Have we reached a point now where the market is telling us enough is enough? It is still early but the market needs to quickly recover and hold support for me to keep my conviction. I am sure the market is focusing on the EUR very intently indeed, so keep those levels on your radar.

Good Luck

Thursday, 19 May 2011

Turning Point Confirmation

Morning All,

Asia had a strong session yesterday that was followed by a strong trading day in the US overnight. Yesterday, I saw a number of bullish patterns lining up and posted about a bullish turning point in Equity markets: http://swingtradersedge.blogspot.com/2011/05/turning-point.html. Last night's follow through triggered many of these patterns and I am looking for more gains in days to come. Advancing issued closed 3.5:1 vs declining issues which I believe confirms this tradeable low. If this is the genuine deal, Asia should go from strength to strength as we close out the week.

S&P 500 60mins:

Price traded back above the 1330 breakdown level confirming the A=C down pattern. Look for breaks of this downward trendline to add, targeting back up to the Daily highs at 1370 and beyond.

S&P 500 June Eminis 60mins:

This 3 Lower Peak pattern worked a treat last night. 3 lower lows in price with 3 higher highs in the momentum indicator are strong indications of a change in trend.

Nasdaq 100:

The upward trendline held and the bearish break of the flag looks set to be a bear trap. Since the liquidity driven bull run began in 09, bearish flag patterns and the like have FAILED to play out. In fact, the trade has been to fade these classic patterns once a confirmation signal has been given. If price recovers from the previous break, get long. There was a v.interesting post the other day by Peter Brandt who highlighted a number of bearish flags: http://peterlbrandt.com/flags-flying-at-half-mast-–-a-sign-of-death/. I stated in the comment field that such flags have actually been very poor performing patterns and great setups to actually do the opposite of anticipated.

EUR 60mins:

The EUR has also broken out of the downward sloping trendline confirming a possible transition from downtrend into a new base/uptrend. Look for breaks of 1.43 for more strength up to 1.445/1.45

Asian Equities are primed for a strong thrust higher here. If this doesn't work, then I fear this market really is tired.

SPI June 60mins:

This is the ending wedge pattern I have been showing for a while. We are set to breakout today

SPI June 15mins:

This morning we are indicated at 4725. As you can see, short term res comes in right here at 4725/4730. Look for breakouts of this zone for a move up to 4760 and then 4785+. I think we will be well bid on any dips down to 4715/4710.

BHP Daily:

I showed this upward sloping trendline off the 08 lows a few days ago. The stock tried to breakdown but has recovered very strongly and formed an Island Reversal candle pattern. Once again note that the intal close below the trendline may have trapped many bears and people calling for a crash etc. Failed signals are often the best trading patterns. This is a GREAT risk/reward trade to get long above 45.

Finally, China is putting in a solid low here with follow through. This has been my area for a long while and finally price is beginning to confirm the setup.

Shanghai Composite Daily:

In sum, I believe that we are on the cusp of good tradeable bounce here in many markets. I am not sure yet how high this can go and for how long. This should not be our concern as we trade first, ask questions later. Certainly, there are some indices that are looking toppy and there are concerns out there as ever. However, the doom and gloomers have been at it again but this market is still clearly in an uptrend and we are now breaking out of consolidation patterns. When an edge appears and setups align, you have to be willing to pull the trigger and go for it.

Thanks

Austin

Asia had a strong session yesterday that was followed by a strong trading day in the US overnight. Yesterday, I saw a number of bullish patterns lining up and posted about a bullish turning point in Equity markets: http://swingtradersedge.blogspot.com/2011/05/turning-point.html. Last night's follow through triggered many of these patterns and I am looking for more gains in days to come. Advancing issued closed 3.5:1 vs declining issues which I believe confirms this tradeable low. If this is the genuine deal, Asia should go from strength to strength as we close out the week.

S&P 500 60mins:

Price traded back above the 1330 breakdown level confirming the A=C down pattern. Look for breaks of this downward trendline to add, targeting back up to the Daily highs at 1370 and beyond.

S&P 500 June Eminis 60mins:

This 3 Lower Peak pattern worked a treat last night. 3 lower lows in price with 3 higher highs in the momentum indicator are strong indications of a change in trend.

Nasdaq 100:

The upward trendline held and the bearish break of the flag looks set to be a bear trap. Since the liquidity driven bull run began in 09, bearish flag patterns and the like have FAILED to play out. In fact, the trade has been to fade these classic patterns once a confirmation signal has been given. If price recovers from the previous break, get long. There was a v.interesting post the other day by Peter Brandt who highlighted a number of bearish flags: http://peterlbrandt.com/flags-flying-at-half-mast-–-a-sign-of-death/. I stated in the comment field that such flags have actually been very poor performing patterns and great setups to actually do the opposite of anticipated.

EUR 60mins:

The EUR has also broken out of the downward sloping trendline confirming a possible transition from downtrend into a new base/uptrend. Look for breaks of 1.43 for more strength up to 1.445/1.45

Asian Equities are primed for a strong thrust higher here. If this doesn't work, then I fear this market really is tired.

SPI June 60mins:

This is the ending wedge pattern I have been showing for a while. We are set to breakout today

SPI June 15mins:

This morning we are indicated at 4725. As you can see, short term res comes in right here at 4725/4730. Look for breakouts of this zone for a move up to 4760 and then 4785+. I think we will be well bid on any dips down to 4715/4710.

BHP Daily:

I showed this upward sloping trendline off the 08 lows a few days ago. The stock tried to breakdown but has recovered very strongly and formed an Island Reversal candle pattern. Once again note that the intal close below the trendline may have trapped many bears and people calling for a crash etc. Failed signals are often the best trading patterns. This is a GREAT risk/reward trade to get long above 45.

Finally, China is putting in a solid low here with follow through. This has been my area for a long while and finally price is beginning to confirm the setup.

Shanghai Composite Daily:

In sum, I believe that we are on the cusp of good tradeable bounce here in many markets. I am not sure yet how high this can go and for how long. This should not be our concern as we trade first, ask questions later. Certainly, there are some indices that are looking toppy and there are concerns out there as ever. However, the doom and gloomers have been at it again but this market is still clearly in an uptrend and we are now breaking out of consolidation patterns. When an edge appears and setups align, you have to be willing to pull the trigger and go for it.

Thanks

Austin

Wednesday, 18 May 2011

Turning Point

Morning All,

Unfortunately this will be a very brief post but will update later in they day.

On Monday I talked about a great target box and buy zone for the S&P 500: http://swingtradersedge.blogspot.com/2011/05/consolidation-or-top.html

I said, "I think we will see more weakness before a meaningful low ensues. An ideal bullish scenario would be a break of 1330 down to 1325 that fails to follow through. Any strong hammers or strength back above 1335 would be a good initial signal to get long, adding above the downward trendline in place. Note there is an open gap at 1320 and a potential A=C projection at 1319/1320".

Last night there was certainly more weakness that went all the way down to the low end of the target at 1319. The strong reversal off the low I believe is indicative of the beginnings of a bottoming process. This is a GREAT risk/reward area to be getting long. No doubt there are dislocations everywhere but it is important to focus on the setup.

S&P 500 60mins:

A=C and the open gap was hit last night. Strong recovery off the lows. Look for breaks back above 1330 to get long adding above the downward trendline. These 3 wave type moves down into support are one of my favourite reversal plays. Stops below last nights low.

S&P 500 Eminis June 60mins:

3 lower peaks with 3 higher highs on the momentum indicator. This is a potential ending diagonal in the making and look for a bullish breakout

ASX200/SPI 60mins:

Yesterday the SPI shrugged off the overnight weakness and held the previous days lows at 4650. I believe we will see more strength today. There are bullish divergences forming and price is holding in at the area of the 61.8 retrace. The bigger picture is a potential ending wedge on the 60mins and thus look for a breakout of this pattern. Short term resistance levels are 4690 and then 4720/4725.

Shanghai Composite Daily:

This market attempted to breakdown yesterday but staged a positive recovery also. We are building a short term range right at the low end of this triangle pattern. Need follow through NOW to confirm a low.

Good Luck

Unfortunately this will be a very brief post but will update later in they day.

On Monday I talked about a great target box and buy zone for the S&P 500: http://swingtradersedge.blogspot.com/2011/05/consolidation-or-top.html

I said, "I think we will see more weakness before a meaningful low ensues. An ideal bullish scenario would be a break of 1330 down to 1325 that fails to follow through. Any strong hammers or strength back above 1335 would be a good initial signal to get long, adding above the downward trendline in place. Note there is an open gap at 1320 and a potential A=C projection at 1319/1320".

Last night there was certainly more weakness that went all the way down to the low end of the target at 1319. The strong reversal off the low I believe is indicative of the beginnings of a bottoming process. This is a GREAT risk/reward area to be getting long. No doubt there are dislocations everywhere but it is important to focus on the setup.

S&P 500 60mins:

A=C and the open gap was hit last night. Strong recovery off the lows. Look for breaks back above 1330 to get long adding above the downward trendline. These 3 wave type moves down into support are one of my favourite reversal plays. Stops below last nights low.

S&P 500 Eminis June 60mins:

3 lower peaks with 3 higher highs on the momentum indicator. This is a potential ending diagonal in the making and look for a bullish breakout

ASX200/SPI 60mins:

Yesterday the SPI shrugged off the overnight weakness and held the previous days lows at 4650. I believe we will see more strength today. There are bullish divergences forming and price is holding in at the area of the 61.8 retrace. The bigger picture is a potential ending wedge on the 60mins and thus look for a breakout of this pattern. Short term resistance levels are 4690 and then 4720/4725.

Shanghai Composite Daily:

This market attempted to breakdown yesterday but staged a positive recovery also. We are building a short term range right at the low end of this triangle pattern. Need follow through NOW to confirm a low.

Good Luck

Monday, 16 May 2011

FX Update

There has been a lot of volatility in the FX markets over the last couple of weeks and I expressed this in my post about trading bias: http://swingtradersedge.blogspot.com/2011/05/bias-in-trading.html. I am seeing a number of interesting developments currently and thus I thought this would be an opportune time to post.

Firstly, the USD index certainly seems to have put in a meaningful low on the Daily chart. The recent move has been strong and impulsive, with a sequence of very strong wide-ranging candles implying a shift in trend. The initial trade is done however. No doubt there is a huge short base out on this index and this really is the driver currently as positions are being unwound. Similar to March 09 in Equities, this is going to go as high as the short base determines. I don't know when that is. I do have short term levels and potential targets coming in here but the key is understanding the shift in momentum in the bigger picture.

DXY Daily Continuous:

The break of the December 09 low proved to be a strong bear trap. Price has regained the 74/74.5 breakdown level with real strength. This is a strong, big-picture Double bottom pattern

DXY Daily Continuous:

Zooming in, the strong thrust off the low looks a lot clearer. Note the bullish divergences that formed prior to the low and the subsequent price confirmation. Price has formed a clear V bottom and broken out of a downward trendchannel. We have hit a target at the 38.2 but it remains to be seen if this is meaningful.

DXY 60mins:

This is the first bit of evidence I look at to suggest that the rally may be cooling somewhat. Price has made 3 higher peaks with my momentum indicator making 3 lower highs. This is a major warning sign and an ending pattern I see time and time again across markets. See USDCHF on the 5th May on the 60mins as an example of a 3 peak ending pattern.

EURUSD 60mins:

This is the similar pattern for EURUSD. It is still early days and we need to see confirmation from price given the downtrend. However, price is looking good for a reversal here especially at the major psychological 1.40 level. In the bigger picture, I would be looking for a good bounce back up into the 1.44/1.45 level to short but that is someway off yet. For now, focus on this potential breakout trade.

EURUSD Daily:

Price is also coming into potential channel support on the Daily. The mid line served to be a very accurate area for the recent high and now we are entering the low end of this channel.

I am seeing some signs of life from AUD which add weight to a slowing of this USD move. AUD has held the 1.055 level on several attempts and I believe this is a tradeable bullish area for nimble traders. Note the strong bullish divergences in place. A bigger picture triangle pattern may be forming so being nimble around here is key until 1.075/1.08 lifts.

AUDUSD 60mins:

AUDUSD Daily:

Price topped recently on peak momentum. In my experience and in my extensive studies, markets very rarely top on peak momentum readings. There is often a subsequent "test" or a failed breakout leading to bearish market divergences. This has not happened yet. Price has retraced to the 38.2 retracement level and hit the rising 55 ema. I think this is a good area for swing longs. I don't think this is cooked yet in the bigger picture.

GBPUSD Daily:

In quite opposite fashion to AUD, GBPUSD appears to be very weak indeed. After months of building a range under 1.63, price initially broke out only for higher prices to be violently rejected. Momentim has gone nowhere. This is a failed breakout and I will be looking for failed rallies and bear flags over the coming weeks to get short.

In sum, USD appears to have put in a major low but is potentially running out of steam in the short term. Some markets like EUR and GBP appear to have put in major tops whereas AUD could well have another assault at its highs and beyond. I think this is all in line with a major market topping process and dislocation as we approach the end of QE2 come June. These mixed signals across asset classes and the strength in the US 10YR imply real dislocation. Trading each market based on its own individual merits and setups is more important than ever now I believe.

Firstly, the USD index certainly seems to have put in a meaningful low on the Daily chart. The recent move has been strong and impulsive, with a sequence of very strong wide-ranging candles implying a shift in trend. The initial trade is done however. No doubt there is a huge short base out on this index and this really is the driver currently as positions are being unwound. Similar to March 09 in Equities, this is going to go as high as the short base determines. I don't know when that is. I do have short term levels and potential targets coming in here but the key is understanding the shift in momentum in the bigger picture.

DXY Daily Continuous:

The break of the December 09 low proved to be a strong bear trap. Price has regained the 74/74.5 breakdown level with real strength. This is a strong, big-picture Double bottom pattern

DXY Daily Continuous:

Zooming in, the strong thrust off the low looks a lot clearer. Note the bullish divergences that formed prior to the low and the subsequent price confirmation. Price has formed a clear V bottom and broken out of a downward trendchannel. We have hit a target at the 38.2 but it remains to be seen if this is meaningful.

DXY 60mins:

This is the first bit of evidence I look at to suggest that the rally may be cooling somewhat. Price has made 3 higher peaks with my momentum indicator making 3 lower highs. This is a major warning sign and an ending pattern I see time and time again across markets. See USDCHF on the 5th May on the 60mins as an example of a 3 peak ending pattern.

EURUSD 60mins:

This is the similar pattern for EURUSD. It is still early days and we need to see confirmation from price given the downtrend. However, price is looking good for a reversal here especially at the major psychological 1.40 level. In the bigger picture, I would be looking for a good bounce back up into the 1.44/1.45 level to short but that is someway off yet. For now, focus on this potential breakout trade.

EURUSD Daily:

Price is also coming into potential channel support on the Daily. The mid line served to be a very accurate area for the recent high and now we are entering the low end of this channel.

I am seeing some signs of life from AUD which add weight to a slowing of this USD move. AUD has held the 1.055 level on several attempts and I believe this is a tradeable bullish area for nimble traders. Note the strong bullish divergences in place. A bigger picture triangle pattern may be forming so being nimble around here is key until 1.075/1.08 lifts.

AUDUSD 60mins:

AUDUSD Daily:

Price topped recently on peak momentum. In my experience and in my extensive studies, markets very rarely top on peak momentum readings. There is often a subsequent "test" or a failed breakout leading to bearish market divergences. This has not happened yet. Price has retraced to the 38.2 retracement level and hit the rising 55 ema. I think this is a good area for swing longs. I don't think this is cooked yet in the bigger picture.

GBPUSD Daily:

In quite opposite fashion to AUD, GBPUSD appears to be very weak indeed. After months of building a range under 1.63, price initially broke out only for higher prices to be violently rejected. Momentim has gone nowhere. This is a failed breakout and I will be looking for failed rallies and bear flags over the coming weeks to get short.

In sum, USD appears to have put in a major low but is potentially running out of steam in the short term. Some markets like EUR and GBP appear to have put in major tops whereas AUD could well have another assault at its highs and beyond. I think this is all in line with a major market topping process and dislocation as we approach the end of QE2 come June. These mixed signals across asset classes and the strength in the US 10YR imply real dislocation. Trading each market based on its own individual merits and setups is more important than ever now I believe.

Subscribe to:

Comments (Atom)