Morning All

I apologise for the lack of updates but I took sometime off at the end of last week. The Blog has been having a great run of late and it is always good to step away for some fresh perspective and re-charge the batteries.

I will have a full run down of analysis and where I think we are at later in the day.

Thanks for the continued emails and comments. Nice to know that people are out there craving for the analysis :)

Austin

Twitter Feed

Wednesday, 30 November 2011

Monday, 21 November 2011

Monday Musings

I like to ramble on a Monday morning. Rather than a long descriptive narrative, I thought I would jot down some of my thoughts as we start the week.

-This blog has been consistently bearish since the S&P500 and DOW hit their respective 200day moving averages. This trade has worked v.well thus far and I don't see any reason to change this stance from a bigger picture perspective. See:

http://swingtradersedge.blogspot.com/2011/10/short-term-high-is-in.html AND

http://swingtradersedge.blogspot.com/2011/11/i-am-bearish.html

-However, in the v.short term I see markets holding in and a potential long trade setting up. Volume has not picked up despite the breakdown, potential bullish divergences are forming and we are coming into a great zone of support in a few markets. Gap downs on Monday mornings often prove to be a good buying opportunity for the nimble.

-The key levels to watch are 1200 to 1210 S&P500 (Eminis 1205 last). Markets had a consolidation day on Friday and I see this move lower on Monday through consolidation as a potential final move lower. This area marks the 38.2 retrace, a potential A=C move, and previous breakout area.

(Update The Eminis are trading 1195 last. This is probably too low. Only a buy if price recaptures 1205/1210 when the Yankees get in. If not, keep focusing on that bigger picture bearish scenario.)

-The target for any long trade should be no more than 1225/1230. This market is only bullish if we can recapture 1250+

-The bigger picture is bearish. We have topping patterns across many markets in place; we have 5 wave impulsive moves off the top; and we have a confirmed DOW Theory Primary trend change to bearish. The bull market trend from the March 09 lows to the May 2011 highs lasted roughly 26 months. The sell off to the October lows was only 5 months and thus not even 20% of the time of the preceding bull market. We need a lot more time to consolidate and work off the previous bull trend excesses. I anticipate this bear phase to last at least 12 months.

-Any failure to bounce meaningfully out of here is bearish and confirms the above. The market failed from this exact zone in 2008. See below. It may not look impulsive of late but if this zone eventually goes, dont hang around.

-The DAX and EUROSTOXX have not made new lows of late. One could argue this is forming a bullish base pattern i.e cup and handle. If we see an upside breakout of this wedge/handle pattern, this could really change my big picture bearish stance. Counter this though with the Nasdaq which has triggered my Head and Shoulders top

-The ASX200 is trading at the low end of its range. The levels I am interested on the long side are 4150/55. Tuesdays are my reversal days and I will be looking for this tomorrow.

S&P500 Support Zone:

S&P500 Support Zone in 2008

S&P500 When support goes......

-This blog has been consistently bearish since the S&P500 and DOW hit their respective 200day moving averages. This trade has worked v.well thus far and I don't see any reason to change this stance from a bigger picture perspective. See:

http://swingtradersedge.blogspot.com/2011/10/short-term-high-is-in.html AND

http://swingtradersedge.blogspot.com/2011/11/i-am-bearish.html

-However, in the v.short term I see markets holding in and a potential long trade setting up. Volume has not picked up despite the breakdown, potential bullish divergences are forming and we are coming into a great zone of support in a few markets. Gap downs on Monday mornings often prove to be a good buying opportunity for the nimble.

-The key levels to watch are 1200 to 1210 S&P500 (Eminis 1205 last). Markets had a consolidation day on Friday and I see this move lower on Monday through consolidation as a potential final move lower. This area marks the 38.2 retrace, a potential A=C move, and previous breakout area.

(Update The Eminis are trading 1195 last. This is probably too low. Only a buy if price recaptures 1205/1210 when the Yankees get in. If not, keep focusing on that bigger picture bearish scenario.)

-The target for any long trade should be no more than 1225/1230. This market is only bullish if we can recapture 1250+

-The bigger picture is bearish. We have topping patterns across many markets in place; we have 5 wave impulsive moves off the top; and we have a confirmed DOW Theory Primary trend change to bearish. The bull market trend from the March 09 lows to the May 2011 highs lasted roughly 26 months. The sell off to the October lows was only 5 months and thus not even 20% of the time of the preceding bull market. We need a lot more time to consolidate and work off the previous bull trend excesses. I anticipate this bear phase to last at least 12 months.

-Any failure to bounce meaningfully out of here is bearish and confirms the above. The market failed from this exact zone in 2008. See below. It may not look impulsive of late but if this zone eventually goes, dont hang around.

-The DAX and EUROSTOXX have not made new lows of late. One could argue this is forming a bullish base pattern i.e cup and handle. If we see an upside breakout of this wedge/handle pattern, this could really change my big picture bearish stance. Counter this though with the Nasdaq which has triggered my Head and Shoulders top

-The ASX200 is trading at the low end of its range. The levels I am interested on the long side are 4150/55. Tuesdays are my reversal days and I will be looking for this tomorrow.

S&P500 Support Zone:

S&P500 Support Zone in 2008

S&P500 When support goes......

Wednesday, 16 November 2011

Some More Bearish Stuff

Morning,

I just wanted to continue on the recent theme I have been drumming home here- I continue to see underlying weakness across markets. CDS prices in Europe continue to make new wides. France, Spain and Italy all made new all time highs last night. Yields on sovereign debt continue to blow out. This despite new heads of state being installed and a Trillion EUR pledged bailout. I don't know what positive catalysts there are still to come but clearly the markets are not paying attention. The US "Super" Committee is also due to release plans to slash $1.2trillion in debt and expect increasing nervousness ahead of this and mumblings of more downgrades if they cant get their act together. I don't have too much faith in them. Most importantly, the technicals are not healthy here and abroad.

France CDS Daily

Breakout to new highs. 2nd biggest economy in the region. All looks healthy here............

I showed a number of bearish patterns in overseas markets in my last few posts: http://swingtradersedge.blogspot.com/2011/11/monday-musings.html

http://swingtradersedge.blogspot.com/2011/11/i-am-bearish-take-2.html

Monday I talked about selling the Emini S&P500 at 1265/1270 looking for mid 40s. This worked out well. That market is obviously in some kind of triangle pattern and volume has continued to dwindle throughout the pattern. We await the breakout either way but I just don't think it will be an upside breakout. The DAX is also flirting with that neckline.

However, I wanted to focus on this post on some confirming evidence here in Asia.

BHP Daily:

The recent stalling action is all indicative of a Wave 4 type pattern. I have labelled a very valid count here. Note the strong bearish reversal candle at $40 and the minor 4 of lesser degree. The bigger picture trend is down and the recent short term rally has run well out of steam. A break of that trendline should initiate a move down into the previous lows and beyond.

RIO Daily:

A Similar count. Note the continued failure to break above $70. This stock is clearly offered. Looking for a breakdown in coming days.

CBA Daily:

Another big component of the Index. The Banks have been major outperformers vs the miners. Nonetheless, CBA tagged the 61.8 retrace and the 200ma and reversed. Up here, it is a low risk short for a move back to $46. I could see Miners making a new low whereas banks make a higher low in time.

ASX200 Daily:

The best risk reward trade here remains selling/shorting up here with stops above 4400. We have a perfect A=C move off the low. We have price reversing off previous highs and at the top end of the channel. We also have a potential short term head and shoulders pattern forming. Any move below 4200 in coming days would trigger this.

AUDUSD 5 days:

The barometer for risk. A market that breaks out from a base pattern and retraces all of its gains and more is not healthy. As per my last post, we have a bigger picture Head and Shoulders pattern in play.

So all in all I remain nervous. The patterns, the fundamentals and the tape are all indicative of a tiring market rally. Perhaps we do breakout to the upside in the S&P500 and I will be forced to join for a trade only. However, I view a BREAKDOWN as more likely.

Thanks

Austin

P.S

Havent shown it for a while. That 200 day capped the rally in 08. Done the same again this time. Hold onto your seatbelts

I just wanted to continue on the recent theme I have been drumming home here- I continue to see underlying weakness across markets. CDS prices in Europe continue to make new wides. France, Spain and Italy all made new all time highs last night. Yields on sovereign debt continue to blow out. This despite new heads of state being installed and a Trillion EUR pledged bailout. I don't know what positive catalysts there are still to come but clearly the markets are not paying attention. The US "Super" Committee is also due to release plans to slash $1.2trillion in debt and expect increasing nervousness ahead of this and mumblings of more downgrades if they cant get their act together. I don't have too much faith in them. Most importantly, the technicals are not healthy here and abroad.

France CDS Daily

Breakout to new highs. 2nd biggest economy in the region. All looks healthy here............

I showed a number of bearish patterns in overseas markets in my last few posts: http://swingtradersedge.blogspot.com/2011/11/monday-musings.html

http://swingtradersedge.blogspot.com/2011/11/i-am-bearish-take-2.html

Monday I talked about selling the Emini S&P500 at 1265/1270 looking for mid 40s. This worked out well. That market is obviously in some kind of triangle pattern and volume has continued to dwindle throughout the pattern. We await the breakout either way but I just don't think it will be an upside breakout. The DAX is also flirting with that neckline.

However, I wanted to focus on this post on some confirming evidence here in Asia.

BHP Daily:

The recent stalling action is all indicative of a Wave 4 type pattern. I have labelled a very valid count here. Note the strong bearish reversal candle at $40 and the minor 4 of lesser degree. The bigger picture trend is down and the recent short term rally has run well out of steam. A break of that trendline should initiate a move down into the previous lows and beyond.

RIO Daily:

A Similar count. Note the continued failure to break above $70. This stock is clearly offered. Looking for a breakdown in coming days.

CBA Daily:

Another big component of the Index. The Banks have been major outperformers vs the miners. Nonetheless, CBA tagged the 61.8 retrace and the 200ma and reversed. Up here, it is a low risk short for a move back to $46. I could see Miners making a new low whereas banks make a higher low in time.

ASX200 Daily:

The best risk reward trade here remains selling/shorting up here with stops above 4400. We have a perfect A=C move off the low. We have price reversing off previous highs and at the top end of the channel. We also have a potential short term head and shoulders pattern forming. Any move below 4200 in coming days would trigger this.

AUDUSD 5 days:

The barometer for risk. A market that breaks out from a base pattern and retraces all of its gains and more is not healthy. As per my last post, we have a bigger picture Head and Shoulders pattern in play.

So all in all I remain nervous. The patterns, the fundamentals and the tape are all indicative of a tiring market rally. Perhaps we do breakout to the upside in the S&P500 and I will be forced to join for a trade only. However, I view a BREAKDOWN as more likely.

Thanks

Austin

P.S

Havent shown it for a while. That 200 day capped the rally in 08. Done the same again this time. Hold onto your seatbelts

P.P.S

(UPDATE)

ASX200 Intraday

Opens +0.4%, Closes -1.5% on lows. Nuff said

Monday, 14 November 2011

Monday Musings

Morning All,

A rather lacklustre start to the week here in Asia. We gapped up 1.5% the open on thin volume in Australia and we have slowly grinded lower throughout the day (just closed FLAT!). I thought I would keep it rather simple this morning and run through a number of things on my mind.

ASX200 Today:

Thoughts

-Fridays rally in the S&P500 was on woeful volumes of 790m only due to Remembrance day. This is the lowest I have seen in months and not indicative of a new impulse move higher.

-The pattern in the S&P500 looks like a clear triangle. A break above 1275 should trigger a "breakout" but I would be very hesitant to join this move given the patterns across other markets and the continued failure at the 200day ma. IN FACT I AM SELLER AT 1265/70 WITH TIGHT STOPS looking for a move back down to the 40s

-The DAX, NASDAQ and AUD, EUR all show very clear Head and Shoulders patterns. These are not my favourite patterns but no doubt they are as clear as day to see. Does that make them invalid? Context is the most important thing in pattern recogniton and note that these patterns are forming after a sustained rally off the October lows that has alleviated a lot of the bearishness. These are the best conditions for putting on shorts.

-There was a potential false break on Friday that got may have got some bears covering. The volume in futures and equities does not validate this however. The market has now rallied sufficiently into great levels to put shorts on. The real trigger comes on close below those supports. When support drops, you got to join it.

-If I had told you 2 months ago that the market would be 12/13% higher, what would you do? I think you would have seen this opportunity as a gift from the gods to get out/get short. Now has anything really changed?

-My major concern for the bearish scenario is the concept of TIME. I have reiterated this a few times. The sell off from the high to low was 5 months. We should expect the rally to be at least 1/2 the time of this i.e. 2 months+. We are closer but not there yet ideally. Furthermore, end of November/December is often seasonally a very strong time of year given end of year dressing This is when all funds are bench marked and trust me, it does have an impact on stocks. That doesn't get investigated though.

NASDAQ 100 60mins:

Looks like a topping pattern to me. Needs confirmation.

SPX 500 60mins:

The market held right onto the trendline I showed here last week. Could be a triangle. Bears need this to drop and soon.

DAX 60mins:

Looks like a H+S to me as long as price doesnt break 6200 on the upside. I would short into this with stops above 6200. Add if we break Fridays lows.

AUDUSD

Another interesting topping pattern playing out potentially with a right shoulder forming. Price should not break above 1.04

EURUSD

False breakdown on Friday that will have bears frustrated. If this rally was to run out of steam and price retraces to Fridays lows, then the pattern really is in play.

Potential 5 down and rally into previous 4th/resistnace?

A rather lacklustre start to the week here in Asia. We gapped up 1.5% the open on thin volume in Australia and we have slowly grinded lower throughout the day (just closed FLAT!). I thought I would keep it rather simple this morning and run through a number of things on my mind.

ASX200 Today:

Thoughts

-Fridays rally in the S&P500 was on woeful volumes of 790m only due to Remembrance day. This is the lowest I have seen in months and not indicative of a new impulse move higher.

-The pattern in the S&P500 looks like a clear triangle. A break above 1275 should trigger a "breakout" but I would be very hesitant to join this move given the patterns across other markets and the continued failure at the 200day ma. IN FACT I AM SELLER AT 1265/70 WITH TIGHT STOPS looking for a move back down to the 40s

-The DAX, NASDAQ and AUD, EUR all show very clear Head and Shoulders patterns. These are not my favourite patterns but no doubt they are as clear as day to see. Does that make them invalid? Context is the most important thing in pattern recogniton and note that these patterns are forming after a sustained rally off the October lows that has alleviated a lot of the bearishness. These are the best conditions for putting on shorts.

-There was a potential false break on Friday that got may have got some bears covering. The volume in futures and equities does not validate this however. The market has now rallied sufficiently into great levels to put shorts on. The real trigger comes on close below those supports. When support drops, you got to join it.

-If I had told you 2 months ago that the market would be 12/13% higher, what would you do? I think you would have seen this opportunity as a gift from the gods to get out/get short. Now has anything really changed?

-My major concern for the bearish scenario is the concept of TIME. I have reiterated this a few times. The sell off from the high to low was 5 months. We should expect the rally to be at least 1/2 the time of this i.e. 2 months+. We are closer but not there yet ideally. Furthermore, end of November/December is often seasonally a very strong time of year given end of year dressing This is when all funds are bench marked and trust me, it does have an impact on stocks. That doesn't get investigated though.

NASDAQ 100 60mins:

Looks like a topping pattern to me. Needs confirmation.

SPX 500 60mins:

The market held right onto the trendline I showed here last week. Could be a triangle. Bears need this to drop and soon.

DAX 60mins:

Looks like a H+S to me as long as price doesnt break 6200 on the upside. I would short into this with stops above 6200. Add if we break Fridays lows.

AUDUSD

Another interesting topping pattern playing out potentially with a right shoulder forming. Price should not break above 1.04

EURUSD

False breakdown on Friday that will have bears frustrated. If this rally was to run out of steam and price retraces to Fridays lows, then the pattern really is in play.

Potential 5 down and rally into previous 4th/resistnace?

Thursday, 10 November 2011

I Am Bearish Take 2

In my last post I talked about a number of bearish setups forming across markets. After recent price action, I have even more conviction that we are on the cusp of a major breakdown. The recent rally has failed spectacularly despite huge pledged government intervention. There are cracks appearing everywhere. Really it is all down to the ECB now and the only solution I see is if they pledge to cap the yields on these sovereign bonds. Otherwise, this market could really get out of control.

S&P500 Daily:

A double failure out of the 200 Day moving average. Yesterdays closing candle was ugly indeed. These reversal candles are indicative of a climatic turning point! A break of 1200 in coming days would seal the fate. Also note that we have had a confirmed Dow Theory Primary trend change indicating the transition from Bull Market to Bear market. I will show this another time.

S&P500 2008

I keep referring to the 2007/2008 parallel. Back then the market topped out right on the 200 day moving average. We then retested the previous breakout zone and once support went, the real collapse began. Look and feel kinda similar?

We have a possible Head and Shoulders pattern forming in the short term. Any break of this trendline overnight will lead to a move down into 1205/1200 at a minimum

DAX Daily:

A classic failed breakout. We had a great base pattern that formed below 6000 and the subsequent breakout failed spectacularly on the 50% Fib retrace. This does not bode well

DAX 60mins:

Another clear short term topping pattern in place. Look for breakdowns of this support.

AUDJPY

Bearish reversal out of the 61.8 and the 200day moving average. It doesn't get much better and clearer than this. This is the barometer of risk/carry trade.

S&P500 Daily:

A double failure out of the 200 Day moving average. Yesterdays closing candle was ugly indeed. These reversal candles are indicative of a climatic turning point! A break of 1200 in coming days would seal the fate. Also note that we have had a confirmed Dow Theory Primary trend change indicating the transition from Bull Market to Bear market. I will show this another time.

S&P500 2008

I keep referring to the 2007/2008 parallel. Back then the market topped out right on the 200 day moving average. We then retested the previous breakout zone and once support went, the real collapse began. Look and feel kinda similar?

.

We have a possible Head and Shoulders pattern forming in the short term. Any break of this trendline overnight will lead to a move down into 1205/1200 at a minimum

DAX Daily:

A classic failed breakout. We had a great base pattern that formed below 6000 and the subsequent breakout failed spectacularly on the 50% Fib retrace. This does not bode well

DAX 60mins:

Another clear short term topping pattern in place. Look for breakdowns of this support.

AUDJPY

Bearish reversal out of the 61.8 and the 200day moving average. It doesn't get much better and clearer than this. This is the barometer of risk/carry trade.

If this plays out, Asia is going down. I thought that this rally would take a lot longer to play out down here but we may not have this luxury. I will not hang around to find out either.

Austin

Tuesday, 1 November 2011

I Am Bearish

Morning All

Since I last posted, the market slightly overran my 200day moving average targets. However, given the price action over the last 2 sessions, I have increasing conviction that we have seen a meaningful high, a high that may even mark the end of this Intermediate rally. I just don't see a good risk/reward trade being long up here.

I have lots of interesting charts here. These are predominately US/European charts. The setups look clearer to me overseas. It is a shame as I predominately trade Asian Indices but right now the world is being driven by these regions so we have to be on the front foot.

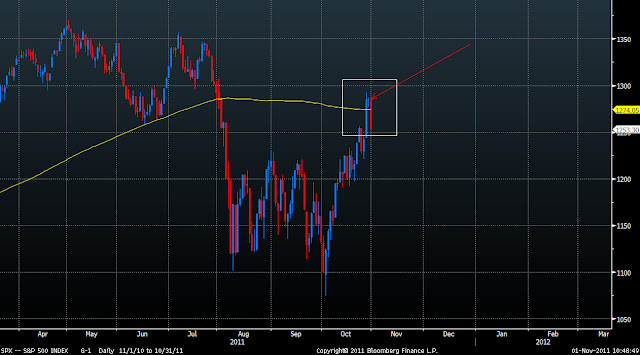

S&P500 Parallel

Lets being with my parallel chart that has guided me so well throughout. We have seen the sharp snapback rally post the double bottom squeeze. In 2008 the market topped right at the 200 day moving average as shown. And now, the S&P 500 hit that same 200 day moving average on Friday and has now reversed. If this plays out, there is a long way down.

S&P500 200 Daily:

The S&P overran the 200day but has swiftly reversed. That reversal candle is bearish indeed.

DOW Full Moon

I thought this was interesting also. I have often commented here that full moons are associated with market turns. The white lines on this chart show the date of the full moons over the past 7-8 months. Note how the market weakened significantly on most occasions post the full moon. Eerie. Yesterdays action could be a sign of things to come.

EURUSD Daily:

A very bearish reversal candle right out of the 61.8 Fib and the 200day. The EFSF rally lasted a whole 3 days and has been completed reversed! Not a major vote of confidence. A potential C wave could well be underway now and this will be sharper than the initial decline.

Italian Bonds vs SP500

They say that the bond market leads risk assets. Here we have Italian Bond Prices in white, SP500 in orange. Well this chart shows a clear divergence between the two. Why are European bonds continuing to fall despite this bailout package? Are equities factoring in whats going on under the hood? Not healthy at all. Expect this Gap to contract i.e. S&P500 to stage a major bearish reversal.

The major issue I am grappling with is the concept of time. This rally has reached my price targets very quickly across markets. I thought it would take a lot longer for this rally to play out and perhaps we do need more time before calling a top. Has all the bearishnesss evaporated already? Seasonally, we are coming into a strong time of year and this throws me off somewhat. However, price is of primary importance and we are firmly in the sell zone.

ASX200 Daily:

Australia has rallied right into the overhead gap and target. Price has confirmed this resistance with some bearish reversal candles. Once again, we led our overseas peers for the recent high. Also note the 3 wave nature of the bounce right into the top end of a channel. A great shorting opportunity in the coming days with stops back above the recent highs.

In sum, there is a lot of evidence to suggest that this whole Intermediate rally is over. I am often early in my market calls but that is the nature of trying to pick favourable risk/reward areas. Much as I positioned for the low, I am now positioning for a dramatic high. If this plays out, it will be a huge trade. In the very short term I think we will get a bounce and I will be using this to put on small shorts. I will add if I see more confirmation.

Good luck

Austin

Since I last posted, the market slightly overran my 200day moving average targets. However, given the price action over the last 2 sessions, I have increasing conviction that we have seen a meaningful high, a high that may even mark the end of this Intermediate rally. I just don't see a good risk/reward trade being long up here.

I have lots of interesting charts here. These are predominately US/European charts. The setups look clearer to me overseas. It is a shame as I predominately trade Asian Indices but right now the world is being driven by these regions so we have to be on the front foot.

S&P500 Parallel

Lets being with my parallel chart that has guided me so well throughout. We have seen the sharp snapback rally post the double bottom squeeze. In 2008 the market topped right at the 200 day moving average as shown. And now, the S&P 500 hit that same 200 day moving average on Friday and has now reversed. If this plays out, there is a long way down.

S&P500 200 Daily:

The S&P overran the 200day but has swiftly reversed. That reversal candle is bearish indeed.

DOW Full Moon

I thought this was interesting also. I have often commented here that full moons are associated with market turns. The white lines on this chart show the date of the full moons over the past 7-8 months. Note how the market weakened significantly on most occasions post the full moon. Eerie. Yesterdays action could be a sign of things to come.

EURUSD Daily:

A very bearish reversal candle right out of the 61.8 Fib and the 200day. The EFSF rally lasted a whole 3 days and has been completed reversed! Not a major vote of confidence. A potential C wave could well be underway now and this will be sharper than the initial decline.

Italian Bonds vs SP500

They say that the bond market leads risk assets. Here we have Italian Bond Prices in white, SP500 in orange. Well this chart shows a clear divergence between the two. Why are European bonds continuing to fall despite this bailout package? Are equities factoring in whats going on under the hood? Not healthy at all. Expect this Gap to contract i.e. S&P500 to stage a major bearish reversal.

The major issue I am grappling with is the concept of time. This rally has reached my price targets very quickly across markets. I thought it would take a lot longer for this rally to play out and perhaps we do need more time before calling a top. Has all the bearishnesss evaporated already? Seasonally, we are coming into a strong time of year and this throws me off somewhat. However, price is of primary importance and we are firmly in the sell zone.

ASX200 Daily:

Australia has rallied right into the overhead gap and target. Price has confirmed this resistance with some bearish reversal candles. Once again, we led our overseas peers for the recent high. Also note the 3 wave nature of the bounce right into the top end of a channel. A great shorting opportunity in the coming days with stops back above the recent highs.

In sum, there is a lot of evidence to suggest that this whole Intermediate rally is over. I am often early in my market calls but that is the nature of trying to pick favourable risk/reward areas. Much as I positioned for the low, I am now positioning for a dramatic high. If this plays out, it will be a huge trade. In the very short term I think we will get a bounce and I will be using this to put on small shorts. I will add if I see more confirmation.

Good luck

Austin

Subscribe to:

Comments (Atom)